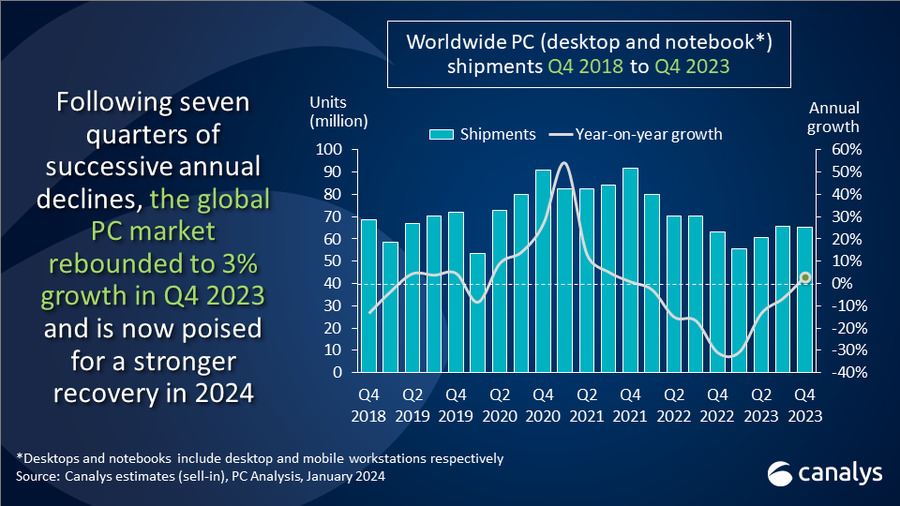

Everyone is at CES this week but the world is still spinning on its axis and it will be interesting to see what our tem at the show will think of all the PC technology on show there. In the meantime, the worldwide PC market, which has been experiencing a period of decline, witnessed a turnaround in the final quarter of 2023. This shift is marked by a modest YoY growth of 3%, with total shipments of desktops and notebooks reaching 65.3 million units. Notably, notebook shipments saw an increase of 4% from 2022, totaling 51.6 million units, while desktop shipments slightly declined by 1% to 13.7 million units.

| Vendor | Q4’23 Shipments | Q4’23 Market Share | Q4’22 Shipments | Q4’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Lenovo | 16,094 | 24.7% | 15,608 | 24.7% | 3.1% |

| HP | 13,937 | 21.4% | 13,204 | 20.9% | 5.6% |

| Dell | 9,915 | 15.2% | 10,807 | 17.1% | -8.3% |

| Apple | 6,577 | 10.1% | 6,019 | 9.5% | 9.3% |

| Acer | 3,988 | 6.1% | 3,561 | 5.6% | 12.0% |

| Others | 14,735 | 22.6% | 14,097 | 22.3% | 4.5% |

| Total | 65,246 | 100.0% | 63,296 | 100.0% | 3.1% |

In the Q4’23 PC market rankings, Lenovo emerged as the leader, shipping 16.1 million units and achieving a 3% annual growth. HP followed in second place, with a 6% year-on-year growth in Q4 shipments. Dell retained its third position, while Apple secured the fourth spot with a 9% growth in Q4. Acer showed a remarkable 12% YoY growth, securing the fifth position for Q4. However, for the full year, Asus occupied the fifth spot in the rankings.

| Vendor | 2023 Shipments | 2023 Market Share | 2022 Shipments | 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Lenovo | 59,106 | 23.9% | 67,731 | 23.9% | -12.7% |

| HP | 52,893 | 21.4% | 55,204 | 19.5% | -4.2% |

| Dell | 39,979 | 16.2% | 49,747 | 17.5% | -19.6% |

| Apple | 23,203 | 9.4% | 27,019 | 9.5% | -14.1% |

| Asus | 16,316 | 6.6% | 20,561 | 7.2% | -20.6% |

| Others | 55,496 | 22.5% | 63,453 | 22.4% | -12.5% |

| Total | 246,994 | 100.0% | 283,714 | 100.0% | -12.9% |

For the entire year of 2023, the PC market saw shipments totaling 247 million units. This figure, however, represents a 13% decrease compared to the previous year. Despite this annual drop, the market is showing signs of positive momentum, particularly with the emergence of AI-capable PCs. These new devices are expected to significantly contribute to the market’s growth during the ongoing refresh cycle and beyond.

Analysts see resilience in the PC industry amidst the challenges of 2023, noting stronger holiday season sales compared to the previous year and inventory corrections in earlier quarters have supported this renewed growth. With macroeconomic conditions improving, companies and individuals who have postponed PC purchases are now likely to resume their spending.

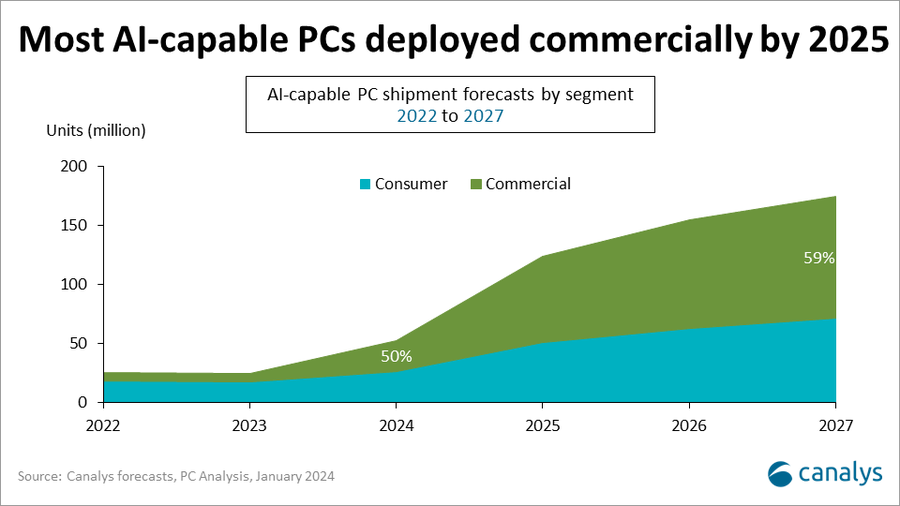

2024 is anticipated to be a pivotal year for the PC industry, especially with the introduction of on-device AI capabilities in PCs. Significant innovations are expected from OEMs and chipset vendors. Canalys predicts that one in five PCs shipped in 2024 will be AI-capable, incorporating dedicated chipsets or blocks like NPUs for on-device AI workloads. This adoption is expected to escalate, particularly in the commercial sector, where on-device AI’s benefits for productivity, security, and cost management are crucial. Canalys forecasts that by 2027, over 170 million AI-capable PCs will be shipped, with nearly 60% being deployed in commercial settings.