Worldwide IT spending will reach $3.54 trillion this year, says Gartner – a minor (0.6%) increase from 2015’s $3.52 trillion. Last year saw the largest USD drop in IT spending since Gartner began tracking the statistic, down $216 billion YoY. The firm does not expect 2014 spending levels to be exceeded until 2019.

John-David Lovelock, research VP at Gartner, blames the fall on the rising US dollar. US multinationals’ revenue “faced currency headwinds” in 2015. “However, in 2016 those headwinds go away and they can expect an additional 5 percent growth”.

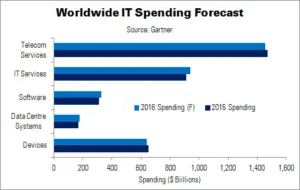

| Worldwide IT Spending Forecast ($ Billions) | ||||

|---|---|---|---|---|

| Category | 2015 Spending | 2016 Spending (F) | 2015 Growth | 2016 Growth |

| Devices | 653 | 641 | -5.8% | -1.9% |

| Data Centre Systems | 170 | 175 | 180.0% | 3.0% |

| Software | 310 | 326 | -1.4% | 5.3% |

| IT Services | 912 | 940 | -4.5% | 3.1% |

| Telecom Services | 1,472 | 1,454 | -8.3% | -1.2% |

| Total | 3,517 | 3,536 | -5.8% | 0.6% |

| Source: Gartner | ||||

The market for devices (PCs, ultramobiles, mobile phones, tablets and printers) is expected to decline 1.9% YoY in 2016. Economic conditions are preventing countries like Russia, Japan and Brazil from returning to stronger growth. In addition, there has been a shift in the phone market in emerging countries to lower-cost models, combined with weak tablet adoption.

Gartner believes that premium ultramobile models will drive the PC market forward, with the move to Windows 10 and Intel’s Skylake platform. The firm has, however, slightly lowered its expected speed of adoption over the forecast period. Purchasing in Eurasia, Japan, the Middle East and North Africa is moving away from these relatively expensive devices. However, a return is predicted for 2017.

Other IT markets that Gartner tracks have been less affected than the devices category. Data centre systems are expected to grow 3% YoY; the enterprise software market will rise 5.3%; and the IT services market will also return to growth (3.1%), after a 4.5% fall in 2015. The only other sector forecast to decline is telecom services, down 1.2%; this category will be hard-hit by the abolition of roaming charges in Europe and parts of North America.