Total GPU shipments were down 3.4% QoQ in Q4’14, with the most noticeable fall in notebooks (3.9%), according to Jon Peddie Research. Desktop GPU shipments were down 2.7%.

Q4 is typically flat or sees a low increase, and this year was well below the 10-year average of a 6.86% rise.

GPU attach rate to PCs was 142.8%, down 10.4% QoQ. 30.2% of PCs had discrete GPUs, which is a 2.2% fall. The overall PC market was up 3.6% QoQ and down 0.7% YoY.

The gaming PC segment, where higher-end GPUs are typically used, was a bright spot. Nvida’s Maxwell GPUs showed strong sales, lifting ASPs for the discrete GPU market.

| Total Graphics Chip Market Shares | ||||

|---|---|---|---|---|

| Vendor | Q4’14 Share (%) | Q3’14 Share (%) | QoQ Change (%) | YoY Change (%) |

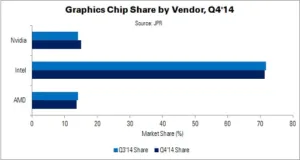

| AMD | 13.6% | 14.1% | -0.5% | -3.7% |

| Intel | 71.4% | 71.8% | -0.4% | 4.5% |

| Nvidia | 15.0% | 14.1% | 0.9% | -0.7% |

| Others | 0 | 0 | 0 | -0.1% |

| Source: JPR | ||||

Nvidia’s overall shipments were up 2.9% QoQ. Discrete desktop shipments were up 5.5% and notebook discretes were down 0.1%.

AMD’s shipments were down 7%. Desktop APU shipments fell 30% QoQ, but were up 4.6% in notebooks. Discrete desktop shipments were down almost 16%, while discrete notebook shipments fell 16.6%.

Finally, shipments were down just under 4% at Intel. The company’s embedded graphics shipments were down 4.4% in desktops and 4.1% in notebooks QoQ.

Total discrete GPU shipments decreased 3.4% QoQ and 12% YoY. The CAGR for total PC graphics between 2014 and 2017 is 1.5%. JPR expects total shipments at the end of the forecast period to be 483 million units. 470 million units are expected to be shipped this year.