Display makers are expanding flexible AMOLED production capacity, to deal with rising demand – largely spurred by the growing popularity of Samsung’s Galaxy S6 Edge and the Apple Watch. IHS says that such displays had a 2% share of the AMOLED market in 2014, but 20% last year – 57 million units. Rigid panel shipments, by comparison, rose 30% to 233 million units.

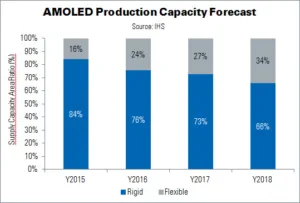

The unit-share shipment of flexible AMOLED displays will continue to rise in the coming years, to a projected 40% in 2020. Production capacity is expected to exceed 1.5 million m² (24% of total AMOLED display production area) this year.

“[T]he growth rate for flexible AMOLED panels is expected to be much higher than for rigid AMOLED panels beginning in 2016”, commented Jerry Kang, principal analyst of display research for IHS.

Data from IHS shows that Samsung Display has lowered its rigid AMOLED manufacturing cost, to compete with LTPS LCDs. However, SDC’s lead in the rigid AMOLED market is prompting other firms to skip the technology entirely and proceed directly to flexible AMOLED production.

“Manufacturers feel it’s already too late to compete in the rigid AMOLED market, where Samsung Display is already so far ahead,” said Kang. “Furthermore, a growing number of smartphone manufacturers, including Apple, are looking to thinner and lighter flexible AMOLED displays to differentiate their products, which is leading even more panel makers to rapidly shift their business focus to flexible AMOLED.”