Flat panel display manufacturers are reporting an increase in fab utilization in the first quarter of 2025, following a slowdown in the fourth quarter of 2024. The improvement comes after demand for TV and IT products began to recover in November 2024.

According to Counterpoint Research, fab utilization started rising in the last months of 2024 after a notable dip that began in the summer and intensified during China’s extended National Day holiday in October. While overall worldwide fab utilization fell slightly in Q3 2024, Q4 saw further reductions as input levels decreased in all regions except Japan. The increases in South Korea and Taiwan were offset by declines in China

The decline in Q4 was largely concentrated in October, when Chinese panel makers paused operations for the holiday. In November and December, fab utilization improved as increased consumer demand in China, driven by government programs, and inventory build-ups by IT and TV brands ahead of tariff changes helped boost output.

Looking ahead to Q1 2025, fab utilization will likely continue to increase, nearing the levels observed in November and December 2024. The steady demand for TVs and a milder seasonal slowdown in the smartphone market are key factors behind the expected uptick.

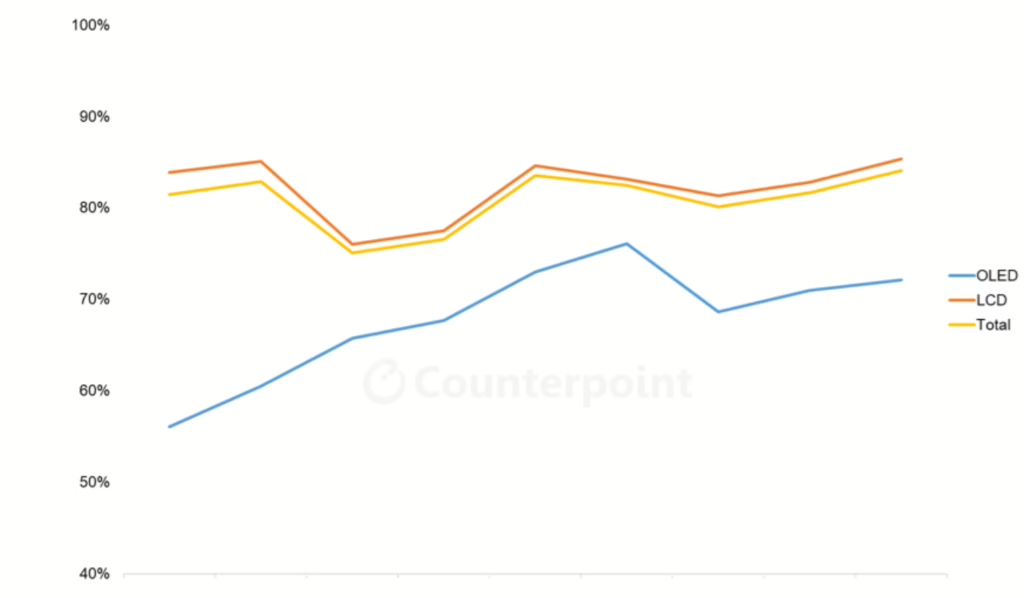

In terms of technology, South Korea’s capacity is now predominantly OLED, while LCD remains dominant in other regions. During Q3 2024, the slowdown was largely confined to LCD lines, with OLED utilization reaching a seasonal peak driven by demand for smartphones and improvements in OLED TV sales. However, OLED utilization dropped more significantly in Q4 2024, particularly on LGD’s OLED TV lines, as the company adjusted production to manage inventory. Despite these shifts, OLED capacity still represents only about 10% of total flat panel display capacity.

Rigid OLED panels, used in notebook PCs and mid-tier smartphones, have grown to account for around 70% of the market since Q2 2024. In contrast, flexible OLED panels, typically employed in premium smartphones, continue to follow a seasonal pattern influenced by product launch cycles and holiday sales, though this pattern was less pronounced in 2024. While industry capacity still exceeds demand, the gap is smaller than it was in 2022–2023. With market conditions remaining uncertain, display manufacturers are likely to continue managing production carefully in 2025 to avoid oversupply.