After several years of successive gains, the MEA tablet market recorded its first-ever YoY decline in Q1’15, says IDC. Shipments fell 5.8%, to just over 3.8 million units. IDC said that the lower performance was caused by a sharp decline in Turkey – the region’s largest tablet market – where shipments were almost halved from a year earlier.

The major reason behind the decline was the discontinuation of shipments for Turkey’s Fatih Project. This had a “huge” impact on commercial demand for tablets in the country during Q1, said IDC’s Fouad Charakla. Additionally, the market was negatively affected by currency fluctuations, high inventory levels (carried over from Q4’14) and some tablet saturation.

Saturation also slowed the tablet market’s performance in other key parts of MEA, as well. Meanwhile, the devaluation of certain major currencies, such as the euro and ruble, had an impact on tablet demand across the region. The lower value of these currencies led to lower international trade and tourism from the affected regions. Additionally, falling oil prices worldwide led to a decline in government spending, negatively impacting demand in both the commercial and consumer segments.

Samsung led the MEA tablet market in terms of shipments, despite these falling 5.5% YoY to 920,000 units. Lenovo overtook Apple, growing to second place for the first time. The Chinese company’s shipments were up almost 96.4%, to 520,000 units. For its part, Apple’s shipments continued to fall – down 43% to 430,000 units.

Huawei (fourth place) was the fastest-growing of the top five vendors in MEA; its 240,000 units shipped represented 280.3% growth. Turkish vendor Casper posted 131.2% growth to take fifth place, with 150,000 units.

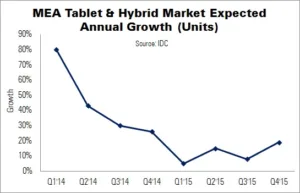

Shipments are expected to rise throughout 2015. IDC forecasts 5.8% growth for the MEA market, to 17.66 million units. However, this is a significant slowdown from the 41.6% growth seen in 2014.

In the long term, the tablet market is expected to continue growing at a ‘healthy’ pace over the coming years. Some PC demand will be cannibalised, IDC believes. However, growth rates – forecast to be 7% in 2016 and 7.9% in 2017 – will be much lower than those of the recent past. Tablet ASPs have fallen recently, but these declines are expected to level off in the coming years.