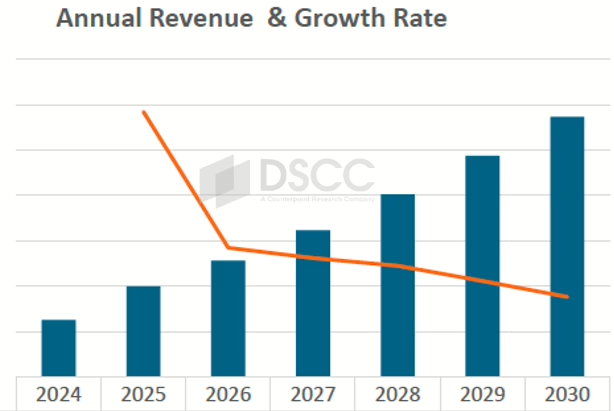

DSCC forecasts a significant shift in advanced semiconductor packaging, projecting the fan out panel level packaging (FOPLP) market—including glass substrate packaging (GSP)—to reach $2.9 billion at a 29% CAGR.

The report shows that complex devices and the growing demand for high-performance solutions are steering chipmakers and packaging suppliers toward newer packaging methods. Glass substrates, lauded for their superior flatness, thermal stability, and mechanical reliability, are poised to enable denser, higher-performance chip packages to support the growing requirements of AI and high-performance computing (HPC) applications.

Although AI and HPC are expected to lead adoption from 2026 onward, automotive and display applications also stand to benefit from FOPLP. Automotive electronics, such as PMICs and sensors used in ADAS systems, gain from more compact and reliable designs, while display makers see promise in GSP (S-PLP) for MiniLED, MicroLED, and Micro OLED displays by taking advantage of reduced warpage, improved transfer yield, and the ability to handle a finer pitch.

Throughout the semiconductor and display supply chains, companies like TSMC, Intel, Samsung, ASE, AUO, and Innolux are heavily investing in FOPLP capabilities and scaling up pilot production lines in anticipation of broader adoption. Despite this optimism, the industry must address challenges around standardizing panel sizes, managing warpage, and ensuring equipment readiness. According to the report’s co-author, an advanced semiconductor packaging specialist in Taiwan, FOPLP is at the forefront of industry evolution.

As materials and processes mature, FOPLP’s role in packaging technologies will expand across multiple sectors, creating lucrative prospects for display supply chain companies that can leverage their expertise in glass substrates.