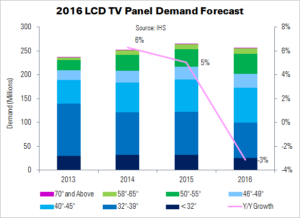

IHS expects LCD TV panel demand to fall 3% YoY in 2016, as a result of TV brands’ continual panel inventory control and global economic uncertainty. Shipments will reach 257 million units.

David Hsieh, senior display director for IHS, said, “TV panel inventory adjustments will continue into the first half of 2016, because more manufacturing capacity will be coming online, especially in China… Global consumption is stagnant and the replacement cycle is slow, which will not support strong growth in the coming year”.

134 million LCD TV panels were shipped in the first half of 2015, IHS’s data shows. Despite falling prices, panel makers have maintained capacity utilisation to continue panel production. They have also purposefully been pushing prices down to encourage TV brands to keep buying for their short-term needs, and upcoming end-of-year sales. All of these factors are expected to negatively impact TV panel demand next year.

According to Hsieh, this is the third year in a row in which panel shipments have passed LCD TV set shipments. TV brands are revising their business plans downward. Combined with the continued slow economic growth, TV makers are expected to be conservative in their 2016 plans.

Although LCD TV panel unit shipments are forecast to decline next year, area demand will rise 3% from 2015 to 125.9 million m². With OLED TV panel area included, the growth reaches 4%.

Panel supply is rising in the 40″ – 43″ segment, and panel price decreases are helping larger sizes take share from the traditional mainstream 32″ size. IHS predicts that 32″ panel unit shipments will fall from 90 million in 2014 and 2015 to less than 80 million in 2016. Meanwhile, 50″ – 55″ shipments will rise from 37 million this year to 41 million next year.

“The collapse of panel prices in the second half of 2015 is encouraging panel makers to shift their product mix, because smaller panel sizes will experience deep losses”, said Hsieh. “Panel makers will be spurred to produce larger panels, which are more profitable, rather than stick with smaller panels with deeply eroded profitability”.

Analyst Comment

AUO CEO Paul Peng recently told UDN that panel oversupply and falling prices mean a bleak outlook for makers, if they do not respond with alternative solutions such as higher-value products. Peng said that AUO is focusing on higher-value, more comprehensive solutions that rely on cooperation with system vendors and software developers. Panel makers cannot rely solely on selling panels any more, he said, but will need to produce complete packages.

AUO is looking at new application areas such as the restaurant and medical segments, rather than traditional applications like notebooks and monitors. (TA)