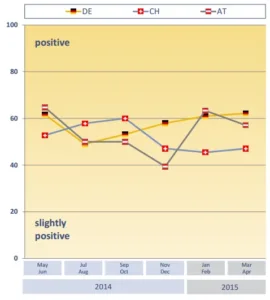

OVAB Europe has released the March/April results for its Digital Signage Business Climate Index (DBCI), which tracks the mood in the signage market in several European regions.

The DACH market rose slightly from the January/February results, to 59.5 base points (from 59.15). Vendors’ view of the current business situation in the region fell slightly. The German market has been held back by the limited progress towards the resolution of the Ukraine crisis and Greek debt problem, while the Austrian market corrected itself after an unusually sharp rise in the previous survey period.

Despite the above, optimism for the near future is positive (although still slightly down compared to the last survey). 60% of the market expects positive growth over the next six months, especially comparing it to 2014. Last year was quiet for the three largest display vendors: Samsung, NEC and LG, which have a combined share of almost 66%.

System integrators see a positive future, as do software vendors. The DOOH market sees the current market down slightly – Q4 is historically a strong point – but expects a more favourable summer.

75% of all DACH signage installations last year were small and medium, with fewer than 50 displays – although these have a higher margin and can be carried out by many market stakeholders. There was also rising demand for entry-level hardware, thanks to falling prices. Only 12% of projects consisted of 100+ display installations.

The importance of the small and medium business market for the signage industry was underlined – SMBs generate 75% of the market’s revenues. The largest vertical markets are retail, corporate communications and banking.