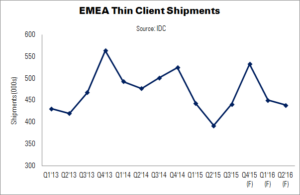

The EMEA thin client market suffered from its third quarter of falling shipments in Q2’15, IDC’s data has shown – reaching its lowest volume in five years. Shipments were down 17.7% YoY to 385,000 units.

Surprisingly, the decline in Western Europe was stronger than that seen during the 2009 financial crisis, dropping 19.2% YoY. Despite low oil prices, the Eurozone’s fragile growth could not provide sufficient incentives for additional hardware upgrades, or new purchases.

Thin client imports continued to be affected by a weak euro-to-dollar comparison, delaying market recovery. However, IDC analyst Oleg Sidorkin said, “As euro rates levelled out after a new valley in Q2 2015, we expect to see single-digit growth in Western Europe in the last quarter of 2015”.

Further shipment declines are expected in the CEE sub-region. Russia still holds about a 50% share in this region, so changes in that country’s economy have a pronounced impact on the region. The current low value of the Russian ruble against the dollar has created risks for importers. IDC has forecast falling shipments for the next three quarters in CEE; recovery will not begin before Q2’16.

In MEA, growth continued to be fuelled by individual projects – it is the only EMEA region to exhibit growth. However, given the record-high shipments of Q3’14, IDC expects it to be difficult for the sub-zone to maintain YoY growth until the end of 2015.