The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) posted solid growth in the second quarter of 2018, with the market going positive (4.1% YoY) and totaling 16.6 million units, according to International Data Corporation (IDC).

The commercial space grew 8.6% YoY as the anticipated device renewals continued to roll out, while the consumer space posted a softer decline (-0.8% YoY), as back-to-school sales, combined with ongoing demand for gaming devices, contributed to the more stable performance. Notebook shipments returned to positive growth (4.7% YoY) after recording a flattish result last quarter, thanks to a solid commercial performance. Desktops saw growth for the second quarter in a row in EMEA (2.0% YoY), driven by their commercial performance and further aided by the tail-end of deal fulfillments.

In Western Europe, the overall traditional PC market grew by 2.9% YoY. Notebooks experienced healthy growth (4.2% YoY), as mobility adoption continued to drive demand in the commercial space. Thin/light and convertible devices continue to gain the most traction on the consumer side. Desktops continued to perform strongly, coming in flat for the second consecutive quarter. Commercial traditional PC shipments in Western Europe increased by an impressive 9.2% YoY, with both product categories registering growth across the region. Northern Europe proved to be strongest this quarter, with Benelux, the Nordics, and the U.K. and Ireland recording double-digit growth following larger refresh cycles.

“Back-to-school and Windows 10 adoption in the enterprise space, from medium to very large businesses, are driving the commercial sector this quarter,” said Liam Hall, research analyst, IDC Western Europe Personal Computing. “Anticipated device renewals, following the last major refresh cycle in 2014 due to the end of Windows XP support, combined with looming security concerns have strongly contributed to the overall performance of the market.”

The consumer PC market in Western Europe declined by 5.6% YoY, as market saturation continued to take its toll. The increasing demand for gaming offered a pocket of growth, and strong back-to-school sales contributed to the more stable consumer performance. Benelux was the only subregion that grew to attain stability, while the rest of the subregions in Western Europe posted single-digit declines.

“The overall PC market in the CEMA region recorded a YoY increase of 6.1%, very much in line with the forecast,” said Nikolina Jurisic, product manager, IDC CEMA. “The CEE region continues to ramp up and over-exceed expectations, with a total PC YoY increase of 6.4%. Strong double-digit PC market growth was recorded in a few countries, including Russia, Czech Republic, and Hungary. There was an increase in both the consumer and commercial sectors, with the strongest growth in the consumer space. Poland, the Baltics, and Ukraine all reported double-digit contractions. The lack of large-scale projects and the inventory build-up in the consumer space inhibited the market. The MEA region performed just below expectations, reporting YoY growth of 5.7%. The market was driven by a commercial sector increase of 10.8% YoY, pushed by large deals in education.”

Vendor Highlights

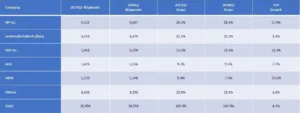

Traditional PC market consolidation has continued, and the top 3 vendors’ share continued to grow in 2018Q2. The top 3 players accounted for 64% of total market volume, compared with 61.1% in 2017Q2.

-

HP Inc. retained the number 1 position in EMEA, gaining 1.8% YoY to reach 28.3% market share. Strong results in notebooks, closely followed by desktops, boosted its results.

-

Lenovo (including Fujitsu) secured the second spot, reporting 22.2% market share (almost flat YoY). Solid performance in the commercial space, in both desktops and notebooks, supported its overall results.

-

Dell Inc. held onto third place with a market share of 13.5% (up 1.3% YoY). Strong commercial results, combined with a solid consumer performance, contributed to its overall growth in the region.

-

Acer came fourth in the overall ranking with 9.1% market share (almost flat YoY). After declining for three consecutive quarters, the vendor returned to positive growth (2.7% YoY) thanks to the back-to-school season.

-

ASUS finished fifth with 7.5% market share (down 2.3% YoY). The vendor continued to struggle, driven by weak results in Western Europe and MEA. In CEE, however, the vendor maintained positive YoY growth in the notebook space.

Top 5 Companies: Europe, the Middle East, and Africa (EMEA) Traditional PC Shipments*

2018Q2 (Preliminary) (000 Units)

Source: IDC Quarterly PCD Tracker (PC Pivot) EMEA Preliminary, 2018Q2, July 2018

Table notes:

-

Some IDC estimates were made prior to financial earnings reports.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

-

Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

-

Data for all vendors is reported for calendar periods.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries worldwide. For more than 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.