Digital TV Research is forecasting that poor results will be seen in pay-TV subscriber numbers in Eastern Europe. Migration coupled with low birth rates will mean that the populations will fall in 15 of the 22 countries between the period, 2016 and 2022, and this will have a knock-on effect on pay-TV subscribers. Pay TV revenues are forecast to fall in 11 of the 22 countries between 2016 and 2022.

Simon Murray, principal analyst at Digital TV Research, stated that the number of TV households will fall in 18 countries between 2016 and 2022, with the region’s total households falling by almost 2 million, with a loss of 1 million subscribers over the same period.

Although the region is moving away from analogue cable TV, belated DTT launches in some countries have resulted in some analogue cable TV households converting to FTA DTT rather than the digital pay-TV platforms.

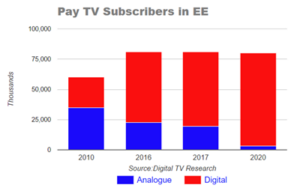

The number of digital pay-TV subscribers are forecast to rise from 25 million (20.2% of TV households) in 2010, to 58 million (45.8% of TV households) in 2016, and by 2022 will reach 77 million (61.0% of TV households).

This year will see the peak for pay-TV subscribers in Eastern Europe, with analogue cable represented 28% of the 81 million pay-TV subscribers at the start of 2017, with some of these 23 million subscribers choosing to convert to FTA DTT rather than to a digital pay platforms.

Pay-TV revenues will peak at $6.11 billion this year before settling at the $6 billion. The contribution by analogue cable will be $1 billion this year, falling to $184 million in 2022.

The number of pay-TV subscribers will fall in 10 countries between 2016 and 2022, although Russia will account for nearly half of the region’s pay-TV subscribers in 2022. Russia’s low pay-TV fees for analogue cable means that Poland generates higher pay-TV revenues than Russia, despite having fewer subscribers. Revenues for market leader Poland will be lower in 2022 than they were in 2010.