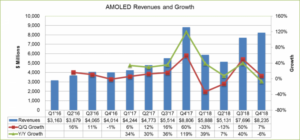

According to DSCC, after a record fourth quarter of 2017, OLED revenues fell 33% quarter-on-quarter in the first quarter of 2018 but grew 39% year-on-year to $5.9 billion. After declining further in the second quarter, they are expected to recover in the second half of the year, with full year revenues reaching $26.95 billion.

OLED Panel Revenues by Quarter, 2016 Q1 – 2018 Q4. Source: DSCC

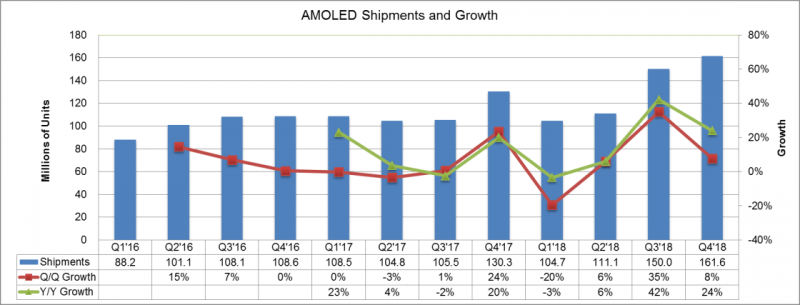

On a unit shipment basis, OLED panels were down 20% quarter-on-quarter in the first quarter of 2018 and 3% year-on-year, as shipments for OLED phone panels decreased. Despite the drop in smartphone units, the smartphone application continued to represent the large majority of OLED panel unit shipments with 92% of all OLED panels, followed by smart watches with 5%.

By application, on a revenue basis in the first quarter of 2018, smartphones represented 88% of panel revenues, while OLED TVs represented 7% and smart watches came in third with 2.3%. Samsung led in revenue with 89% share, followed by LG at 9.5%. Third-place supplier Visionox captured only 0.7% of OLED revenues but showed impressive year-on-year growth of 425%.

OLED Panel Unit Shipments by Quarter, 2016 Q1 – 2018 Q4. Source: DSCC

OLED Panel Unit Shipments by Quarter, 2016 Q1 – 2018 Q4. Source: DSCC

In the smartphone sector, Samsung surpassed Apple in the first quarter of 2018 to take the number-one spot for OLED revenues, due to Apple’s order cut. These two top brands consumed 79% of OLED panels by revenue in the first quarter of 2018.

ASPs for OLED smartphone panels declined in the first quarter as Samsung dropped prices of rigid panels aggressively to win business at Chinese handset makers and compete with LTPS LCD. Samsung is maintaining high prices for flexible OLED panels, which inhibits demand but maintains high margins, while other panel suppliers are too small to influence price. Therefore, DSCC expects flexible prices to decline gradually during the second half of 2018.

Across all applications, flexible panels declined to 40.8% unit share in the first quarter of 2018 on a 36% quarter-on-quarter decrease. Flexible revenue declined 41% quarter-on-quarter and revenue share declined to 65% from 74% in the fourth quarter of 2017. DSCC estimates that flexible units will rebound in the third quarter of 2018, up 95% quarter-on-quarter, and will reach a 49% unit share by the fourth quarter, mainly from high-end models from tier-1 brands.

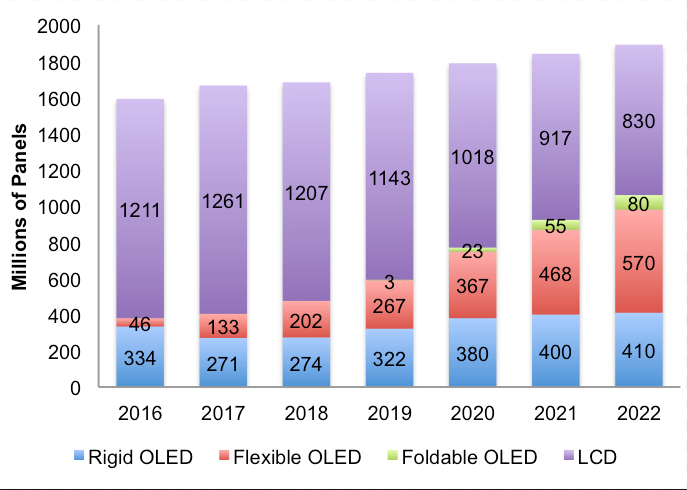

Analysts have predicted that OLED phone panel shipments will increase continuously on an annual basis, while LCD smartphone panel shipments decline. Total OLED phone panel shipments are expected to surpass LCD in 2021.

Smartphone Panel Shipments by Technology and Form Factor. Source: DSCC

Smartphone Panel Shipments by Technology and Form Factor. Source: DSCC

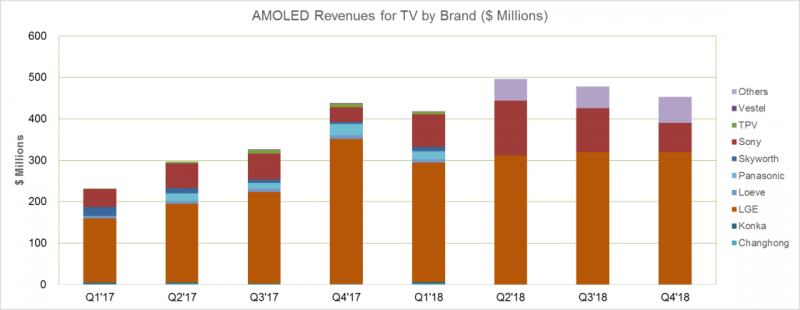

In the TV sector, OLED panel shipments dropped 5.8% quarter-on-quarter but increased 116% year-on-year in the first quarter of 2018. LG consumed 70% of OLED TV panels, followed by Sony and Panasonic.

OLED TV Panel Revenues by Brand 2017 – 2018. Source: DSCC

OLED TV Panel Revenues by Brand 2017 – 2018. Source: DSCC

The slowdown in OLED panel sales led to a dramatic reduction in OLED fab utilisation, with total industry utilisation falling from a high of 85% in October 2017 to a low of 48% in February 2018.

Samsung’s rigid fab utilisation bottomed out in February and is expected to exceed 80% in June, as lower prices fuel demand growth. Its flexible fab utilisation bottomed out in April and is expected to reach 52% in June, with new 5.85” iPhone production starting in May and 6.46” iPhone production starting in June.

Analysts have predicted that OLED panel revenues will continue to increase at double-digit growth rates, with peak growth of 32% in 2020, and will increase to $57.2 billion in 2022.

Smartphones will remain the dominant application for OLED panels throughout the forecast period. DSCC estimates that smartphones will represent 91% of unit shipments and 79% of revenues in 2022. Smartwatches will continue to be the number-two application in terms of units, while TV will continue to be the number-two application in terms of revenue.

TV panel revenues will increase to $6.2 billion in 2022, representing an 11% market share, with 13 million OLED TV panel unit shipments.