Display Supply Chain Consultants (DSCC) is pleased to announce the latest issue of their Quarterly OLED Materials Report.

Prepared in collaboration on an exclusive basis with the OLED Association, it combines DSCC’s deep knowledge on OLED capacity, shipments, yields and fab utilization with the OLED Association’s knowledge on OLED device structures, OLED material prices, and the OLED material supply chain.

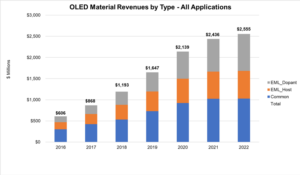

The report tracks all the major materials used to produce flexible OLEDs, rigid OLEDs, and OLED TVs. Both emitter and common material markets are quantified in revenues, units, area, and volumes by application through 2022. Design wins and OLED materials supplier share are also provided.

Additional Report Findings

OLED Material Revenues – All Applications:

- Small/Medium applications are expected to continue to be the largest source of demand for OLED stack materials, with growth at a 24% CAGR from $513 million in 2017 to $1.52 billion in 2022, holding at 59% of the total OLED stack materials market.

- Revenues for TV applications will grow slightly slower than the overall market at 23% CAGR from $344 million to $963 million. This forecast anticipates the arrival of inkjet printing technologies that will enable RGB OLED structures at a relatively lower material cost.

- Material sales for OLED Lighting will grow at a 43% CAGR from $11 million in 2017 to $69 million in 2022, growing from 1.2% to 2.7% of the total OLED material market.

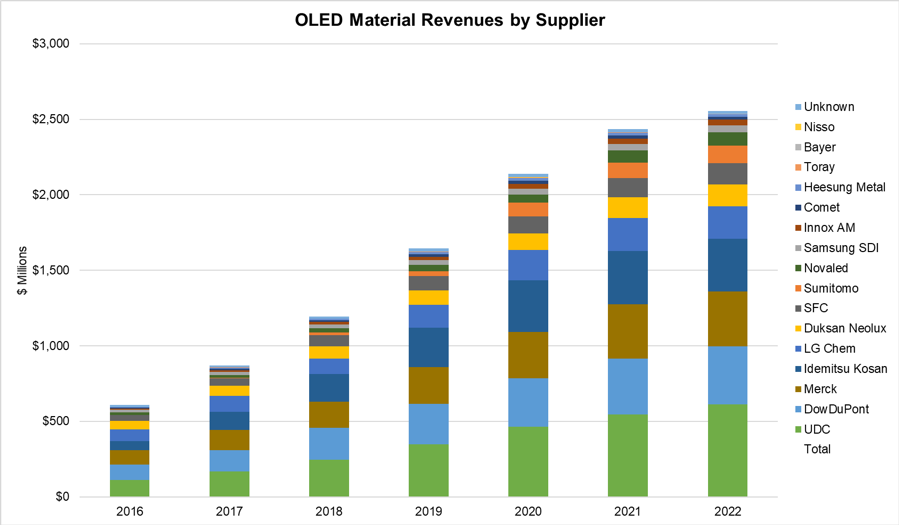

- As shown in Figure 2, among material suppliers, Universal Display Corporation receives the highest revenues from OLED material sales, with their material sales expected to grow at a 30% CAGR through 2022 to more than $600 million, and their share of the overall material market to grow from 19% in 2017 to 24% in 2022. Dow Dupont and Merck will continue to hold the #2 and #3 positions among OLED material suppliers, with 15% and 14% of the market in 2022, respectively.

Materials Companies Included in Report

- Universal Display Corporation

- DowDupont

- Merck

- Idemitsu Kosan

- LG Chemical

- Sumitomo Chemical

- Novaled

- Duksan Neolux

- SFA

- Innox AM

- Samsung SDI

Overview

- OLED device structures

- Material classifications

- Material development trends

Introduction

- OLED material descriptions

- Industry value chain descriptions

- Supplier profiles

- Supplier matrix

- Material pricing

OLED Material Forecasts (2016-2022)

- Shipment volumes and revenue projections

- Average prices (ASPs)

- Segmented by:

- Panel supplier

- Application – Mobile, TV, Other

- Form factor – Rigid vs. Flexible

- Segmented by:

Materials covered include:

Organic Layers

- Small molecule emissive material (EML)

- Polymer emissive material (EML)

- Red, Green, Yellow, Blue host material (EML)

- Red, Green, Yellow, Blue dopant material (EML)

- Hole injection material (HIL)

- Hole transport material (HTL)

- Electron transport material (ETL)

- Electron injection layer material (EIL)

- Barrier layers (BL)

For more information on DSCC’s Quarterly OLED Materials Report, please contact [email protected], call 512-577-3672 in the US and 81-90-4597-5632 in Japan or visit here.