Display Supply Chain Consultants has released its latest quarterly report on OLED supply, OLED demand and the OLED equipment market.

The report also contains the latest OLED fab schedules, OLED capacity forecasts, OLED yields by fab, OLED panel shipment forecasts by application, OLED supply/demand scenarios taking foldable and rollable displays into account. Detailed forecasts and market share of rapidly growing OLED equipment market segments, including evaporation, ink jet printing, lithography and excimer laser annealing are all included.

The report also quantifies how many OLED fabs will be necessary to saturate the smartphone market, as well as forecasting significantly increased spending on OLED TV capacity from 2020, on 10.5G fabs as inkjet printing and soluble materials mature.

Ross Young, CEO of Display Supply Chain Consultants, highlighted some of the report finding, as follows:

- OLEDs are growing rapidly as the entire smartphone market is expected to convert to OLEDs over the next 6-8 years as OLEDs offer improved display performance and their ability to be made flexible will enable larger displays in existing form factors through foldable and rollable implementations.

- OLEDs will be made lighter with increased ruggedness and innovative foldable and rollable designs, enabling smartphone brands and OLED suppliers to increase their average selling price.

- With Samsung’s and Apple’s smartphone brands expected to control over 60% of OLED capacity until 2019, there is a legitimate fear among other smartphone brands that they will not be able to secure sufficient OLED supply and these brands are encouraging more panel suppliers to enter the OLED market and asking existing suppliers to add more capacity.

- Samsung Display has shown that OLEDs can generate higher margins than LCDs and as OLED smartphone demand is strong, most of the display industry is now racing to build mobile OLED capacity.

- OLED fabs are significantly more capital intensive than LCD fabs, and this will translate into record spending on display manufacturing equipment in 2017 and elevated spending for years until the smartphone and other applicable mobile markets are fully penetrated.

Other highlights from this report include:

- 72 different phases of OLED fab capacity investments from 2016 to 2021, including 12 lower probability fabs.

- Realistic OLED input capacity is expected to rise at a 40% CAGR from 7.6 million square metres in 2016 to 40.5 million square metres in 2021.

- Mobile displays are expected to account for at least a 72% share of OLED input capacity each year.

- Apple is expected to account for 28% of mobile input capacity in 2018, from 0% in 2016, before declining to 20% of capacity by 2021 as others grow.

- Most of the mobile capacity investments will be for flexible displays. As a result, flexible mobile OLED capacity will overtake rigid capacity in Q4 2017 on an input basis and Q2 2018 on an output basis.

- Korea is expected to account for the highest share of capacity through the forecast, but falling from 94% in 2016 to 69% in 2021.

- China’s OLED capacity is expected to rise at a 99% CAGR with its share rising from 5% in 2016 to 27% in 2021.

- OLED TV capacity is expected to rise at a 37% CAGR on an input basis and 33% on an output basis in 55” equivalents to 8.4 million 55” panels in 2021.

- OLED panel shipments are expected to rise at a 30% CAGR from 395 million in 2016 to 1.46 billion in 2021.

- Mobile displays are expected to account for at least a 90% share of OLEDs each year.

- VR headsets and smart watches are expected to be the second and third applications on a unit basis depending on the year.

- OLED TVs are expected to rise at a 47% CAGR and reach 5.9 million units in 2021.

- OLED smartphone shipments are expected to rise at a 26% CAGR and should overtake LCDs in the smartphone market in 2019.

- LCD smartphones are projected to fall at an 8% CAGR from 1.2 billion units in 2016 to 806 million in 2021.

- Apple and Samsung are expected to consume most of the OLED supply growth in 2017 and 2018.

- There will not be an OLED smartphone display surplus until 2019. The surplus in 2019 is expected to be 10%.

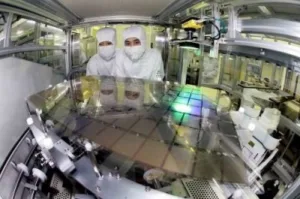

OLED Manufacturing

Analyst Comment

As I highlighted in my talk at the Electronic Display conference recently, OLED is taking one tentacle of the scope of the ‘LCD Monster’, the smartphone segment. I would expect it to gradually take all the mobile applications from tablets up to notebooks. It may also add automotive as lifetimes are improved. However, it’s not obvious that OLED will take the market for displays that are less sensitive to weight/thickness issues in the medium term.

DSCC also said that the speakers at its Business Conference during the SID will be ‘OLED heavy’. (BR)