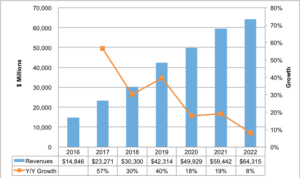

DSCC released the forecast slides for the Q1’18 issue of its Quarterly OLED Shipment and Fab Utilization Report and said that it has revised the outlook for 2018 down by 22%, but still expects to see 30% growth to $30.3 billion. The key factors are lower than expected iPhone X shipments, reduced fab utilization at Samsung and related fab delays

From 2017 to 2022, the firm now expects 23% CAGR instead of 27% CAGR with the 2022 market reaching $64.3 billion instead of $79.6 billion. It is still a rapidly growing market as most consumers prefer OLEDs and OLED capacity is still growing rapidly. It is just growing slower than previously expected.

Figure 1: Latest OLED Revenue and Growth Forecast

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

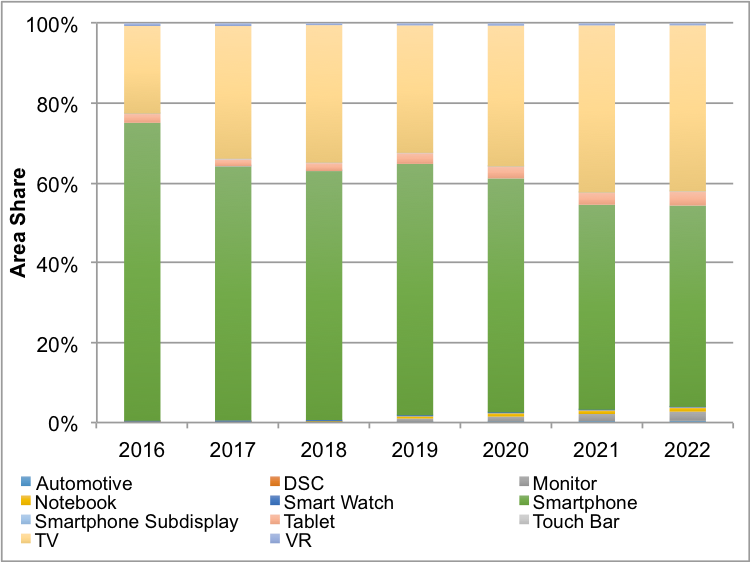

Smartphones are expected to remain the dominant market, accounting for around 91% of units per year with the smartphone revenue share falling from an 87% share in 2018 to a 79% share in 2022. On an area basis, smartphones are expected to fall from a 64% share in 2017 to a 50% share in 2022 as shown in Figure 2, with TVs rising from 33% to 42% and tablets the third largest application with a 3.5% share.

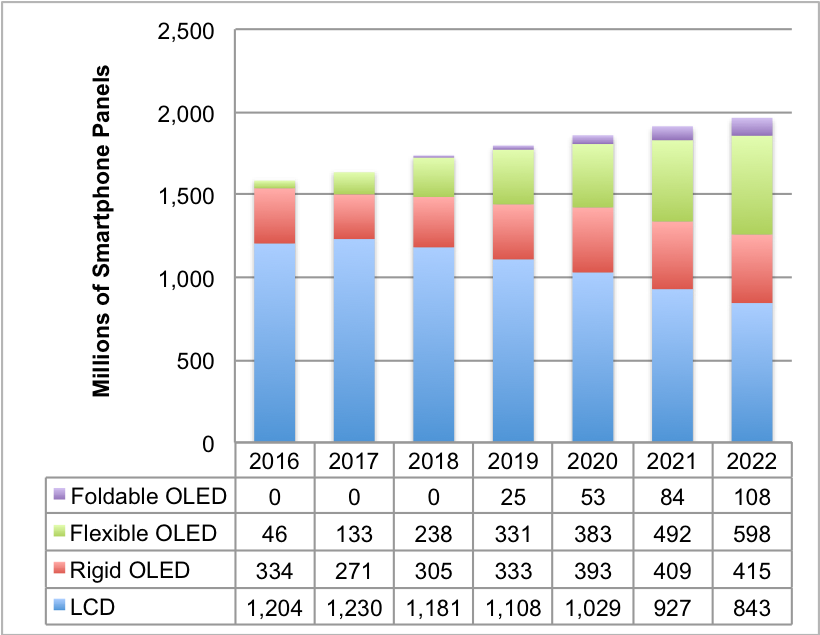

Our latest OLED smartphone panel forecast shows 543 million units in 2018 compared to the prior forecast of 622 million units, a 13% reduction, but still up 34% Y/Y. In particular, flexible OLED smartphones were adjusted downward by 22% for 2018 to 238 million units, but still up 70% Y/Y. Rigid OLED smartphones were reduced by 4% compared to last quarter for 2018, but are still projected to rise 12% Y/Y. Blended OLED smartphone ASPs were also adjusted downward, due to lower prices stemming from lower fab utilization and lower flexible OLED penetration. We now see OLED smartphone ASPs at $49 for 2018 compared to the prior forecast of $56 with flexible OLED smartphone ASPs at $83 instead of $90, a 7% reduction, and rigid OLED ASPs at $22 instead of $23, an 8% reduction.

Figure 2: OLED Area Share by Application

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

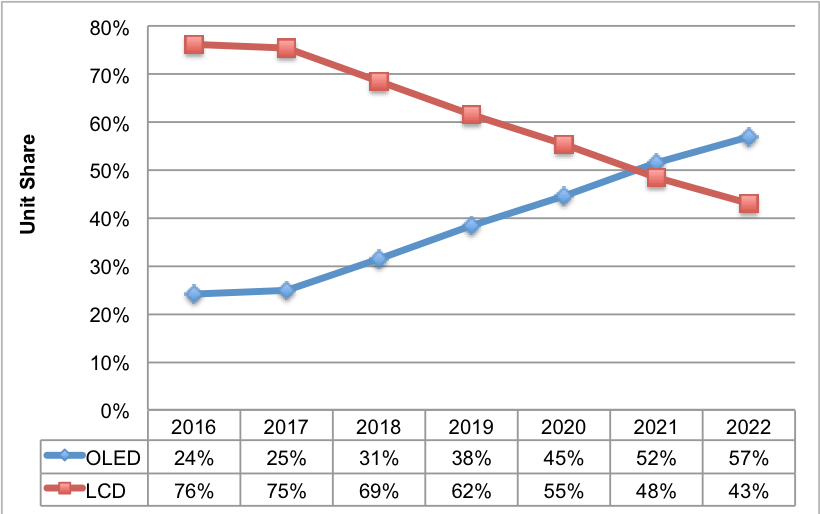

OLED smartphones are now forecast to grow at a 23% CAGR vs. a 24% CAGR in last quarter’s report, reaching 1.12 billion units instead of 1.27 billion units. OLEDs are expected to overtake LCDs in smartphones in 2021 as shown in Figure 3 and reach a 57% unit share of the total smartphone market. We expect small volumes of foldable OLED smartphone panels in 2018 and expect them to grow to 108 million units in 2022, approximately 10% of the OLED smartphone market and 5% of the total smartphone market. LCD smartphone panels are expected to fall at a 7% CAGR from 1.2 billion in 2017 to 843 million in 2022 as capacity falls in this segment on lack of profitability and inability to match foldable OLEDs.

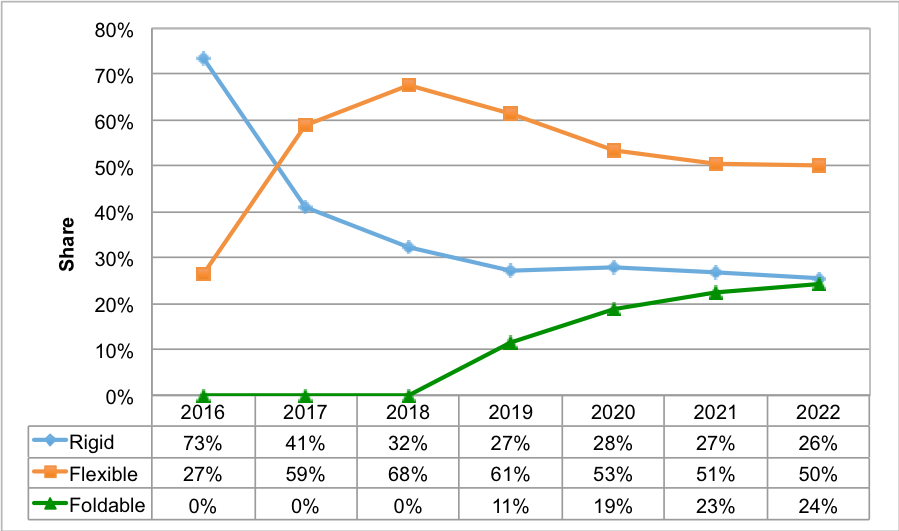

On a revenue basis for all applications by 2022, as shown in Figure 5, we expect foldable OLEDs, with their significantly higher prices, to account for 24% of the OLED market with flexible at 50% and rigid at 26%. There is no question that a high percentage of the new capacity is going towards flexible and foldable which will push down prices and drive their growth. Flexible/foldable revenues are expected to grow at a 28% CAGR vs. rigid at an 11% CAGR and total OLED revenues at a 23% CAGR.

With more expensive flexible and foldable OLEDs gaining share along with larger sizes, we expect blended OLED ASPs to be relatively flat throughout the forecast at around $52. The average OLED size is expected to rise by 21% from 5.4” in 2017 to 6.6” in 2022 and OLED area output is expected is expected to rise at a 35% CAGR to 13.1 million m².

DSCC said it is now doing more model-level tracking of sales.

Figure 3: OLED vs. LCD Smartphone Panel Unit Share

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Figure 4: Smartphone Panel Shipments by Type

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report

Figure 5: OLED Revenue Share by Form Factor

Source: DSCC’s Quarterly OLED Shipment and Fab Utilization Report