Display Supply Chain Consultants (DSCC) has released its latest LCD and OLED equipment spending, capacity and supplier market share results and forecasts as part of its Quarterly Display Capex and Equipment Service.

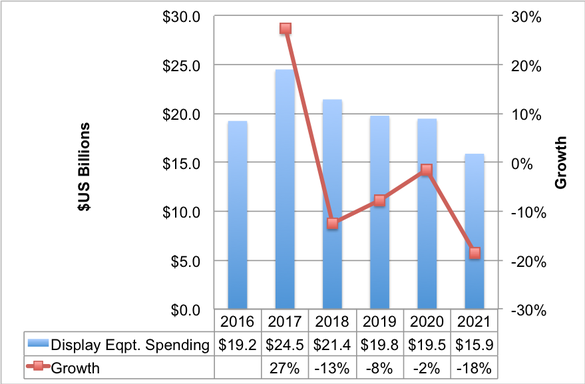

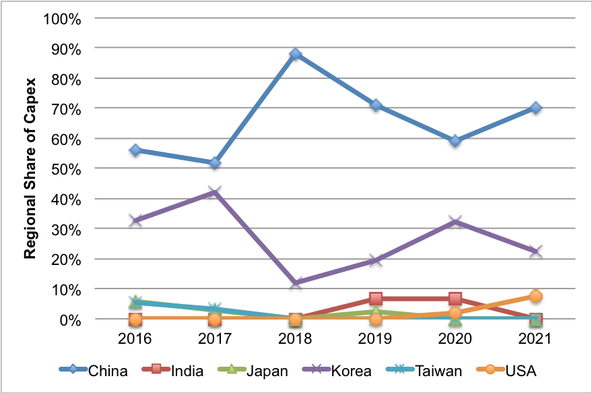

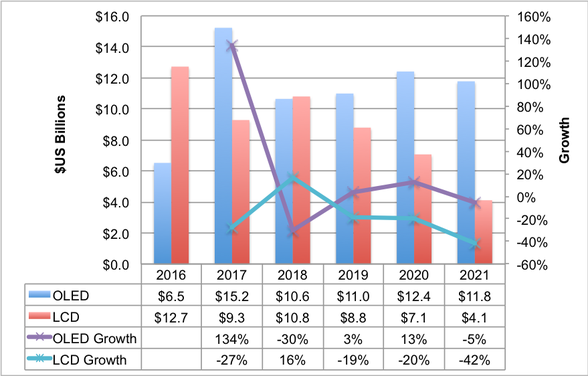

From 2017 to 2022, display suppliers are predicted to spend $109B as shown in Figure 1, down from $116B predicted last quarter, to meet the demand for larger and higher resolution TVs and thinner, lighter and flexible mobile displays. While 2017 was a record year, 2018 is expected to be a down year outside of China with total spending down 13% vs. DSCC’s previous forecast of a 9% decline. Korea’s share of spending is expected to fall from 42% in 2017 to just 12% in 2018, a 75% decline. However, in China, equipment spending is expected to rise 49% in 2018 and account for an 88% share as shown in Figure 2. DSCC’s 2018 equipment spending of $21B is expected to be evenly split between LCD and OLED fabs with LCD spending rising 16% and OLED spending falling 30%. However, from 2019, OLED spending and growth is expected to outpace LCD spending as shown in Figure 3.

Figure 1: DSCC’s Latest Display Equipment Spending Forecast

Source: DSCC’s Quarterly Display Capex and Equipment Service

Figure 2: Regional Share of Annual Display Capex

Source: DSCC’s Quarterly Display Capex and Equipment Service

Figure 3: Display Equipment Spending and Growth by Technology

Source: DSCC’s Quarterly Display Capex and Equipment Service

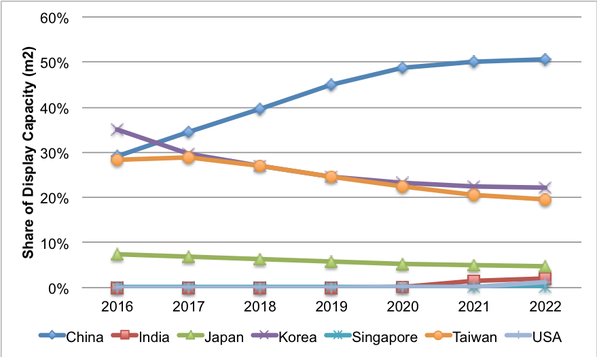

According to DSCC CEO Ross Young, “Despite weakness in current mobile OLED fab utilization, we continue to see healthy levels of OLED and LCD fab spending in China with awards and POs updated weekly in our Weekly PO and Equipment Award Database. China is clearly driving display spending and will account for an 88% share of display equipment spending in 2018 consisting of 83% of OLED equipment spending and 93% of LCD equipment spending at a total of $18.9B. China’s capacity growth is expected to rise at a 17% CAGR from 2017 through 2022, with no other region growing over 3%. As a result, China’s share of display capacity is expected to rise from 35% to 50% as shown in Figure 2. By 2020, China will have more than a 2X higher share than Korea or Taiwan.”

In 2019, DSCC forecasts equipment spending of $21B, down 8% from 2018, which is 20% below our prior forecast due to continued delays at Samsung. In 2019, China will account for 71% of equipment spending vs. Korea at 19%. In 2020, we expect Samsung and LG to add significant capacity with $19.5B in equipment spending which is 5% ahead of previous expectations, but down 2% Y/Y. China will still lead in equipment spending at 59% vs. Korea at 32%.

Bookings are expected to fall 23% in 2018 due to fab delays, but positive bookings growth is expected in 2019 and 2020. As a result, the display book to bill was 0.94 in 2017 and is expected to fall to 0.83 in 2018 before rising to 0.96 in 2019 and 1.01 in 2020.

While LCD and OLED spending is expected to split the market 50/50 in 2018, the OLED share is forecasted to gain share each year thereafter, reaching ~75% in 2021 and 2022 as OLED demand continues to outpace LCD demand. From 2018 – 2021, OLED equipment spending should hold a 60/40 advantage over LCD.

From 2018 – 2021, we expect BOE to account for 25% of equipment spending at $19.2B with LG Display at $13B and a 17% share and China Star at $11B and a 15% share. 13 different display companies are expected to spend over $1B on equipment over these four years, 9 of them in China. BOE should reach #1 in display capacity in 2019 with a 17.5% share. While it will lead in LCDs from 2019, it will reach #3 in OLEDs and #2 in mobile OLEDs from 2020. If all of Foxconn’s display companies are considered a single entity, then Foxconn is the #1 supplier in 2017 and 2018 on a capacity basis before being overtaken by BOE in 2019.

From 2018 – 2021, exposure equipment is expected to be the #1 category with a 10% share followed by VTE at 8.6% and CVD with a 5% share. Design wins and market share are provided for every fab investment by equipment type from 2016 – 2022.

The latest issue of DSCC’s Quarterly Capex and Equipment Service added PI Coaters as a separate category and quantified the additional spending associated with integrated on-cell OLED touch sensor manufacturing, which is called Y-OCTA by Samsung. The Y-OCTA process flow, number of lines and the amount spent per line is quantified in the latest issue.

DSCC will also be organizing the SID Business Conference during Display Week on May 21st at the Los Angeles Convention Center where 3 Chinese display suppliers will be participating – BOE Technologies, Tianma Microelectronics and Visionox. At the same event, leading equipment suppliers Applied Materials, Coherent and CoreFlow will also be participating. Please contact [email protected] for more information.

Figure 4: Regional Share of Display Capacity

Source: DSCC’s Quarterly Display Capex and Equipment Service

About DSCC

Display Supply Chain Consultants (DSCC) was formed by experienced display market analysts from throughout the display supply chain and delivers valuable insights through consulting, syndicated reports and events. The company has offices in the US, China, Japan and Korea. They can be found on the web at http://www.displaysupplychain.com and can be reached in the US at [email protected] or (512) 577-3672.