Display Supply Chain Consultants (DSCC) has released the industry’s first report dedicated to foldable display technology and the foldable display market.

This report took 9 months to produce, provides deep insight into what it will take to commercialize foldable displays and forecasts foldable display yields, costs, capacity, shipments, prices, revenues, area and more.

The report reveals:

- Why foldable displays must succeed;

- What the key challenges are and industry solutions to overcome those challenges;

- What changes are required to the backplane and frontplane processes to maximize yields and foldability;

- What are the requirements, new materials and manufacturing processes for foldable touch sensors, optically clear adhesive (OCA) materials, circular polarizers, cover films, hard coats and foldable glass covers;

- What kind of mechanical solutions are required;

- Cost and price forecasts for multiple sizes and resolutions;

- Capacity and yield forecasts with yield scenarios by tier;

- Segmentation of the foldable market into 6 distinct segments;

- Shipment forecasts by application, size, area, units, revenues, ASPs, etc.;

- Foldable supply vs. demand;

The report also answers the following important questions:

- How OLEDs are made flexible?

- How OLEDs are made foldable?

- What are the biggest challenges and most likely solutions?

- How much more will foldable OLEDs cost than flexible and rigid OLEDs?

- How fast will foldable capacity grow?

- What are the likely yields for Tier 1, 2 and 3 suppliers?

- Where is yield loss the greatest concern?

- What are brands and panel suppliers foldable roadmaps?

- How big will the foldable market get on an area basis, unit basis and revenue basis?

- ?What sizes will be introduced first and what sizes are likely to lead the market?

- ?What panel sizes are likely to dominate the tablet and keyboard-less notebook market?

- Are keyboard-less notebooks really going to happen?

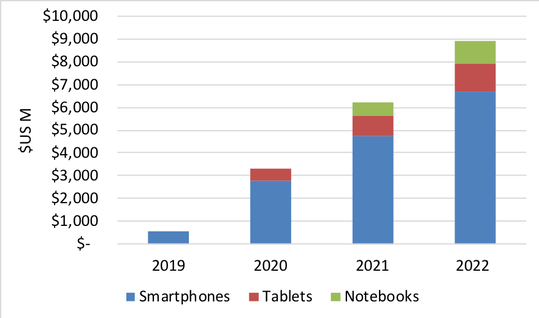

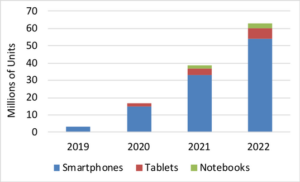

DSCC projects the foldable display market will start out slow reaching 3.1M units in 2019 with Samsung Electronics and Huawei launching foldable smartphones in Q1’19. After 2019, growth will accelerate as shown in Figures 1 and 2 as costs and prices fall, availability improvesand competition increases enabling foldable displays to expand into tablets, notebook PCs and other market segments. By 2022, DSCC sees the foldable market for all applications at 63M units, a 173% CAGR. On a revenue basis, DSCC shows 151% CAGR in display revenues to $8.9B in 2022.

According to DSCC CEO Ross Young, “This was a very challenging report to write as it encompasses so many different aspects of the display market. It required expertise on display manufacturing, process flows, many different types of display materials and how they are manufactured, hinge solutions, cost modeling, capacity modeling, brand and panel supplier surveys and roadmap discussions, demand forecasting, price forecasting and calculating supply vs. demand. We also met with many brands and panel suppliers and discussed their roadmaps and most are quite excited about the long-term prospects for foldable displays. They are hoping the innovative form factor and ability to incorporate larger displays into smaller form factors will drive ASPs and revenues higher.”

For more information on DSCC’s 250-slide Foldable Display Market and Technology Report including a detailed table of contents, please visit https://www.displaysupplychain.com/foldable-display.html.

DSCC is also hosting the Future of Display Technologies and Markets Conference on November 6th at the Santa Clara Convention Center in Santa Clara, CA. where it will be discussing its outlook for foldable displays. More information for this event can be found at: https://bit.ly/2R2UY5z.

DSCC CEO Ross Young will also be presenting excerpts of this and other reports at the Bay Area SID Chapter meeting on October 16th. Please visit http://www.sid.org/Chapters/Americas/BAChapter.aspx for more information.

Figure 1: Foldable Display Market Unit Forecast

Figure 2: Foldable Display Market Revenue Forecast