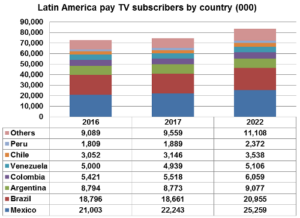

Although the economic recession waned somewhat in 2017, the Latin American Pay-TV sector was still affected. According to Digital TV Research, the number of Pay-TV subscribers was flat year-on-year. Fewer than 5 million additional Pay-TV subscribers are expected between 2017 and 2023, bringing the total to almost 76 million. Pay-TV penetration will not climb beyond the current 44% of TV households.

Simon Murray, Principal Analyst at Digital TV Research, said:

“Given its continuing economic and social problems, Brazil lost 1 million Pay-TV subscribers between 2015 and 2017. Its peak year of 2014 will not be bettered until 2023. Mexico recorded impressive growth in 2016, but its Pay-TV subscriber count fell in 2017. It will continue to decline until a slow recovery starts in 2020. The 2023 total will be just under the 2016 peak. However, it’s not all bad news as Claro and Telefonica will enter Argentina and Mexico, although this is likely to involve OTT”.

Mexico overtook Brazil in 2016 to become Latin America’s largest Pay-TV market, despite Brazil having twice as many TV households as Mexico. Brazil has been losing subscribers since November 2014. However, Brazil will regain top slot in 2023—just. Pay-TV revenues in Latin America (subscriptions and PPV) will grow by only 1.0% between 2017 and 2023 to $19.74 billion. Revenues will fall in 2017, 2018 and 2019 before a slow recovery begins.

Brazil ($7.01 billion in 2023) will remain the top country in terms of Pay-TV revenues by some distance, followed by Mexico ($2.49 billion) and Argentina ($2.49 billion). Brazilian subscription rates are much higher than Mexican ones. However, Brazil’s 2023 total will be lower than 2017 and the peak year of 2014.

Two operators dominate Pay-TV in Latin America—Claro/America Movil had 13.91 million Pay-TV subscribers (down by half a million on the previous year) by the end of 2017 and DirecTV/Sky had 21.31 million. These two companies accounted for nearly half of the region’s Pay-TV subs by the end of 2017.