Worldwide device (PCs, tablets, ultramobiles and mobile phones) shipments are forecast to reach 2.5 billion this year: up 1.5% from 2014, although down from the Q4’14 forecast of 2.8% growth.

Gartner expects end-user spending to reach $606 billion. Despite the rise in unit sales, this represents a 5.7% decline YoY – the first fall since 2010.

Ranjit Atwal, research director at Gartner, explained, “[The lower forecast] was partly due to a continued slowdown in PC purchases in Western Europe, Russia and Japan in particular, largely due to price increases resulting from local currency devaluation against the dollar”.

After the Windows XP migration, the PC market suffered from an unfavourable YoY comparison in the first half of 2015. However, currency depreciation against the dollar is still having a greater effect. PC vendors continue to reduce inventory levels – by at least 5% to end-2015 – to minimise price reductions in the channel.

Gartner expects PC shipments to reach 300 million units worldwide this year: a 4.5% fall. The market is not forecast to recover until 2016. “The release of Windows 10 on [the] 29th July will contribute to a slowing professional demand for mobile PCs and premium ultramobiles in 2015, as lifetimes extend by three months,” said Atwal. “However, as suppliers and buyers adjust to new prices, Windows 10 could boost replacements during 2016”.

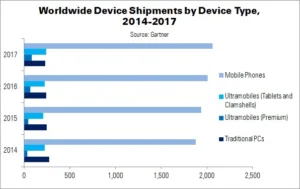

| Worldwide Device Shipments by Device Type, 2014-2017 (Millions) | ||||

|---|---|---|---|---|

| Device Type | 2014 | 2015 | 2016 | 2017 |

| Traditional PCs | 277 | 251 | 243 | 233 |

| Ultramobiles (Premium) | 37 | 49 | 68 | 89 |

| Total PC Market | 314 | 300 | 311 | 322 |

| Ultramobiles (Tablets and Clamshells) | 226 | 214 | 228 | 244 |

| Computing Devices Market | 540 | 514 | 539 | 566 |

| Mobile Phones | 1,879 | 1,940 | 2,007 | 2,062 |

| Total Devices Market | 2,419 | 2,454 | 2,546 | 2,628 |

| Source: Gartner | ||||

Ultramobiles (tablets and clamshells) will also fall this year. Shipments are expected to total 214 million units (down 5.3% YoY), with tablets accounting for 207 million of these (down 5.9%).

Fewer new buyers are now entering the tablet market. In addition, life cycles are rising and there is little innovation to encourage new purchases, said Gartner’s Roberta Cozza. “At the same time, the value of a smartwatch for the average user is still not compelling enough and the impact of these wearables on tablet purchases remains negligible”, she added. Gartner has also noticed users relying on their smartphones more than tablets, as both functionality and size increase. This is particularly affecting the appeal of small tablets.

Because of the above, Gartner has extended its view of the average lifetime of a tablet to three years, by 2016. Penetration will reach 50% of households in mature markets next year.

The mobile phone market is the only segment that continues to show growth, although prices are falling. Emerging markets, particularly China, are driving global smartphone adoption.

Growth rate for mobile phones will slow to 3.3% in 2015. China’s weakening performance is having a significant impact on the market. “Vendors in China will have to win replacement buyers and improve the appeal of their premium offerings to attract upgrades, if they want to maintain or increase their market share”, said research director Annette Zimmermann.

Zimmermann advised vendors seeking global smartphone growth to look beyond China, into other emerging markets.