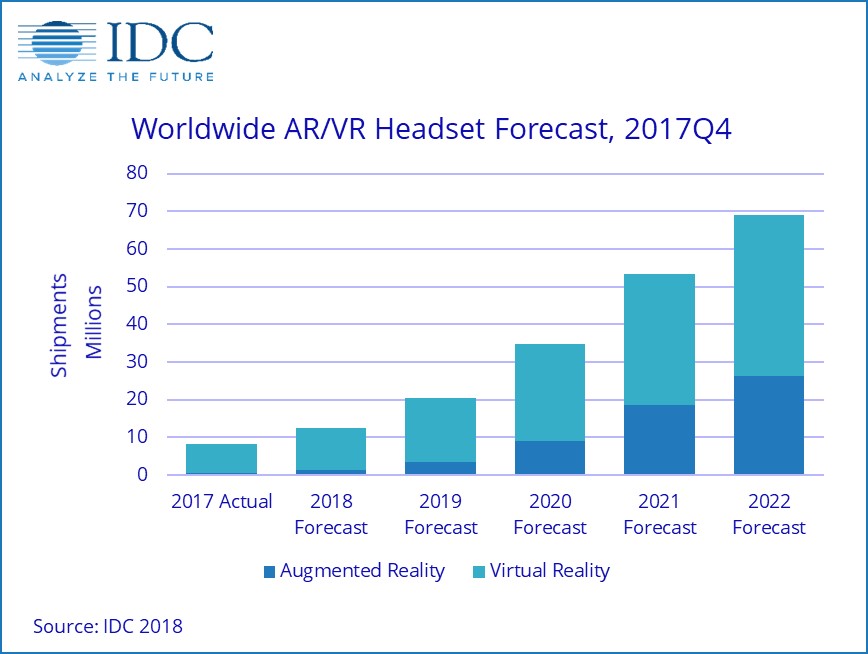

Worldwide shipments for augmented reality (AR) and virtual reality (VR) headsets will grow to 68.9 million units in 2022 with a five-year compound annual growth rate (CAGR) of 52.5%, according to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker.

Despite the weakness the market experienced in 2017, IDC anticipates a return to growth in 2018 with total combined AR/VR volumes reaching 12.4 million units, marking a year-over-year increase of 48.5% as new vendors, new use cases, and new business models emerge.

The worldwide AR/VR headset market retreated in 2017 primarily due to a decline in shipments of screenless VR viewers. Previous champions of this form factor stopped bundling these headsets with smartphones and consumers have shown little interest in purchasing such headsets separately. While the screenless VR category is waning, Lenovo’s successful fourth quarter launch of the Jedi Challenges Mirage headset—a screenless viewer for AR—showed the form factor may still have legs if paired with the right content. Other new product launches during the quarter included the first Windows Mixed Reality VR tethered headsets with entries from Acer, ASUS, Dell, Fujitsu, HP, Lenovo, and Samsung.

“There has been a maturation of content and delivery as top-tier content providers enter the AR and VR space,” said Jitesh Ubranisenior research analyst for IDC Mobile Device Trackers. “Meanwhile, on the hardware side, numerous vendors are experimenting with new financing options and different revenue models to make the headsets, along with the accompanying hardware and software, more accessible to consumers and enterprises alike.”

Looking ahead, IDC also expects the VR headset market to rebound in 2018 as new devices such as Facebook’s Oculus Go, HTC’s Vive Pro, and Lenovo’s Mirage Solo ship into the market with new capabilities and new price points. Meanwhile, with the exception of screenless viewers, AR headsets are likely to remain largely commercially focused until later in the forecast due to the technology’s high cost and complexity.

“While there’s no doubt that VR suffered some setbacks in 2017, companies such as Google and Facebook continue to push hard toward making the technology more consumer friendly,” said Tom Mainelli, program vice president, Devices & AR/VR research. “Meanwhile, Lenovo’s success with its first consumer-focused AR product shows that consumers are beginning to understand what augmented reality is and the experiences it can provide. This bodes well for the category long term.”

Category Highlights

Augmented Reality head-mounted displays will see market-beating growth over the next five years as standalone and tethered devices grow to account for more than 97% of the market by 2022. IDC expects AR screenless viewers, the overall market leader in 2017, to peak in 2019 as standalone and tethered products become more widely available at lower price points. The rise of screenless viewers geared toward consumers tilted shipment volumes away from commercial viewers in 2017 and that’s likely to continue in 2018; by 2019 the segment will shift back toward more commercial shipments.

Virtual Reality head-mounted displays will see a shift in product mix. Screenless viewers, once the overall leader, will see share erode quickly over time. Meanwhile, standalone and tethered devices – in the minority in 2017 – will comprise 85.7% of total shipments by 2022. Consumers will account for a majority of headset shipments throughout the forecast, but commercial users will slowly occupy a larger share, growing to nearly equal status in 2022.

|

AR/VR Headset Market Share by Form Factor, 2018 and 2022 |

|||

|

Technology |

Form Factor |

2018* |

2022* |

|

Augmented Reality |

Screenless Viewer |

6.7% |

1.1% |

|

Standalone HMD |

2.4% |

19.1% |

|

|

Tethered HMD |

1.0% |

17.9% |

|

|

Virtual Reality |

Screenless Viewer |

34.9% |

8.8% |

|

Standalone HMD |

11.7% |

29.8% |

|

|

Tethered HMD |

43.3% |

23.3% |

|

|

Total |

|

100.0% |

100.0% |

|

Source: IDC Worldwide Quarterly AR and VR Headset Tracker, March 19, 2018 |

|||

*Note: Forecast values.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.

All product and company names may be trademarks or registered trademarks of their respective holders.