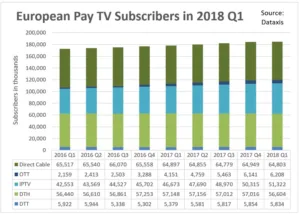

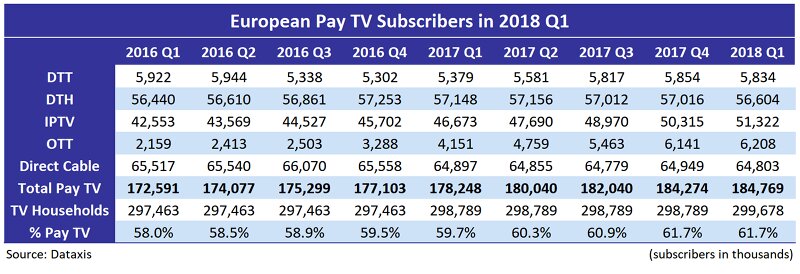

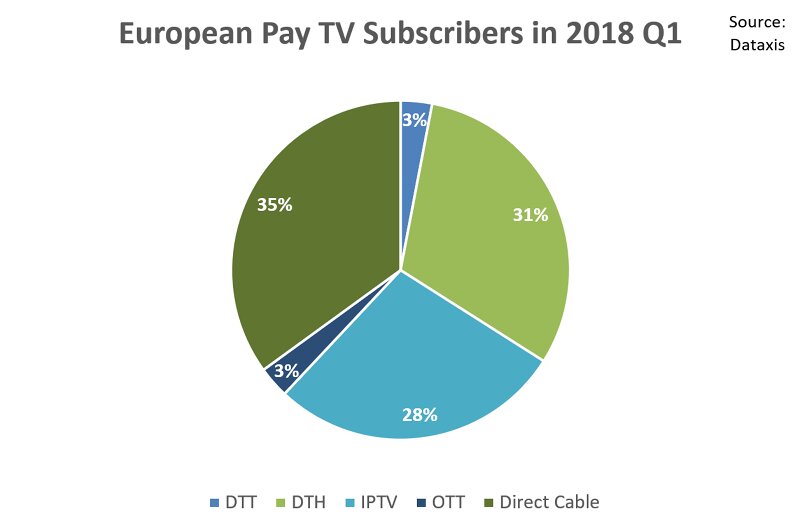

According to Dataxis, the European pay TV market reached 185 million subscribers during the first quarter of 2018 and grew only by 0.3% compared to the fourth quarter of 2017. This is the lowest net add ever observed by Dataxis. 35% of pay TV subscribers receive direct cable, 31% satellite and 28% IPTV. OTT and DTT both represent only 3% of the subscriber total.

Direct cable is still the most used technology in Europe and represents almost 65 million subscribers, including 42 million using digital cable, but decreased slightly in the first quarter of 2018. Liberty Global/Vodafone accounts for 31% of subscribers. The indirect cable market amounts to 18 million customers.

The satellite (DTH) market decreased more substantially in the first quarter of 2018, with 400,000 fewer subscribers than in the fourth quarter of 2017, a decline of 0.72%. Dataxis estimates that Sky Group and Tricolor (Russia), which together hold 50% of the market, have lost 140,000 and 80,000 customers respectively.

The DTT market remained stable in the first quarter of 2018, losing only 0.35% of its subscribers, but nonetheless declined, despite the launch of Freenet in Germany in 2017, which accounted for 18% of DTT subscribers and gained 47,000 customers during the last quarter.

On the other hand, the IPTV market in Europe continued its growth in the first quarter of 2018, with 1,000,000 more subscribers compared to the fourth quarter of 2017, an increase of 2%. The main players in this market are Orange (France) and Rostelecom (Russia), which account for 10% and 13% of IPTV subscribers, respectively.

Despite representing only 3% of the pay TV market, OTT grew significantly in terms of subscribers, especially when compared to the fourth quarter of 2016, an increase of 47%. Play Now (Poland) holds 25% of total OTT subscribers.