According to the latest research from Counterpoint, global mobile handset profits grew 13% year-on-year in the third quarter of 2017, due to the strong performance of Samsung and Chinese brands.

This is the first time that the cumulative profit of Chinese brands has exceeded $1.5 billion in a single quarter. The majority of profit was previously shared by just two brands—Samsung and Apple.

The growth of Chinese brands can be attributed to the country’s diligent efforts in streamlining its supply chain with a rising mix of mid to high-end smartphones. Even in the premium segment, players like Huawei are positioning their flagship models just below the premium offerings from Apple and Samsung. This strategy is designed to penetrate the premium market while maximising revenue and profit.

Apple continued to command the lion’s share of mobile handset industry profits, capturing almost a 60% share. However, this is down from an 86% share in the same quarter last year, when Samsung suffered losses due to the Galaxy Note 7 problems. With stronger demand for the Note 8 and the mid-tier, high-scale J series, the Korean vendor has been able to re-capture almost a quarter of the global mobile handset industry’s profits.

Apple still generates more than $150 profit per iPhone sold and this will continue to grow into the holiday season quarter, buoyed by the high price of the iPhone X. Our recent channel checks across key Apple markets showed that the demand for the 256GB version of the iPhone X is higher, which will boost Apple’s profits even further.

Market Summary

- Apple captured nearly 60% of the total profits generated in mobile handset segment, followed by Samsung.

- Apple’s profit share declined by 30% year-on-year, mainly due to an increased mix of previous-generation iPhones. The average selling price of the iPhone remained flat year-on-year, while shipments increased 3% year-on-year.

- In the fourth quarter of 2017, we estimate that Apple’s total profits will improve, driven by iPhone X sales. Apple exited the quarter with some iPhone 8 inventory due to a softer-than-expected demand compared to the iPhone 7.

- Samsung made a strong comeback in the third quarter with the Note 8, while the S8 series continue to perform on par. The company’s profit share reached 26%, compared to the loss it made during the third quarter of 2016 due to the recall and discontinuation of the Note 7.

- Huawei witnessed the highest profit growth of 67% year-on-year in the third quarter of 2017 due to its portfolio expansion across price bands. Huawei’s smartphone ASP grew by 6% year-on-year, driven by its Mate and P series.

- Oppo and Vivo captured the fourth and fifth spots in global profit share, mainly driven by their performance in China.

- While Xiaomi has made a strong comeback with a profit growth of 41% year-on-year, it is still behind the market leaders. For Xiaomi, offline distribution is the key to reaching the level of Oppo or Huawei, but most of Xiaomi’s sales are still skewed towards lower-end models. Xiaomi needs premium flagship models like the Mi Mix 2 or Mi 6 series to scale and drive higher profits and offset its offline expansion costs. Xiaomi is rumoured to be in the pre-IPO phase; instilling confidence in its investors that it can scale and make more money will be key next year.

- The expansion of Chinese players outside China will have an impact on the profit margins of Chinese players, which they hope to mitigate by increasing the mix of mid-segment devices in markets outside China.

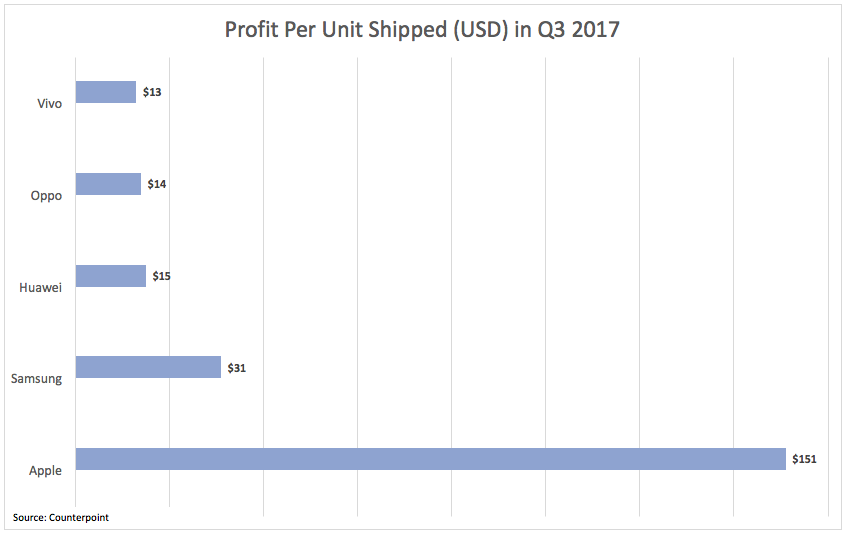

Profits per unit sold

- Apple’s per unit profit is five times higher than Samsung and approximately 14 times higher than the average per unit profit of Chinese brands. Apple’s per unit profit stood at $151 in the third quarter of 2017.

- With its global presence, Samsung has one of the highest number of models across price bands. Its profit per unit was $31 in the third quarter of 2017

- Chinese brands like Huawei, Oppo and Vivo are all performing similarly in terms of profits per unit, each having an average per unit profit of $15, $14 and $13 respectively.

- Compared with other Chinese brands, Xiaomi’s per unit profit is $2, as it plays on very thin margins.