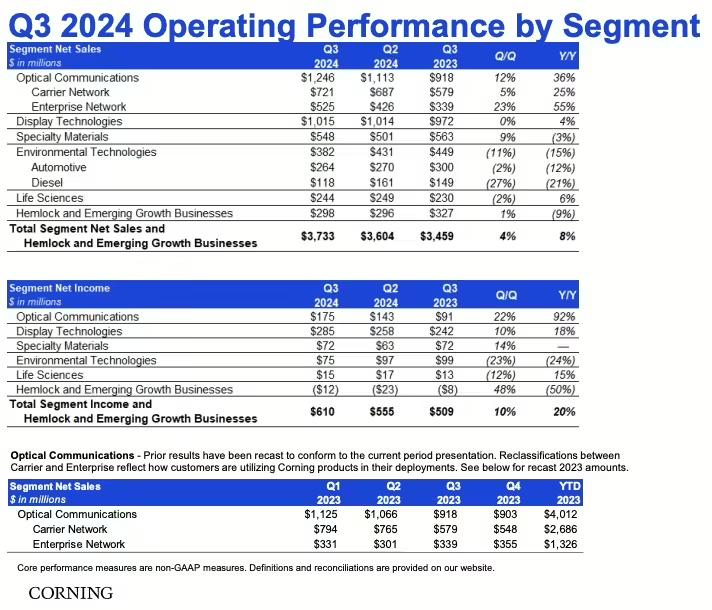

Corning’s Display Technologies segment demonstrated solid growth in Q3 2024, reporting sales of $1.0 billion, an increase of 4% YoY. The segment achieved a net income of $285 million, marking an 18% YoY rise and a 10% sequential increase. However, the display segment faced challenges, as panel manufacturers lowered utilization rates, which led to a sequential decline in display glass volume. This trend is anticipated to continue into Q4, with Corning forecasting further decreases in both glass market demand and volume.

Despite these short-term headwinds, Corning’s long-term outlook for the display segment remains cautiously optimistic. The company expects the glass market to grow at a modest, single-digit rate in the coming years, driven by stable TV sales and gradual increases in screen sizes (roughly at a rate of one inch a year). To sustain profitability, Corning has implemented price increases for its glass products, aiming to counterbalance the impact of the weaker Japanese yen and maintain stable US dollar-denominated net income. The majority of Corning’s yen exposure is hedged for 2025 and 2026, a strategic move that reinforces its financial stability.

Looking ahead, Corning projects net income for the display segment to reach between $900 million and $950 million in 2025, with a continued net income margin of approximately 25%, in line with recent performance. While Q3 showed positive results, Corning is navigating near-term market adjustments with proactive pricing and hedging strategies to ensure long-term profitability and growth stability.