Corning expects its Display Technologies and Environmental Technologies segments to be key growth drivers for the remainder of 2024, company executives said during their first-quarter earnings call.

| Corning Financial Results (in millions of dollars) | Q1’25 | Q1’24 |

|---|---|---|

| Net sales | $3,452 | $2,975 |

| Cost of sales | 2,238 | 1,982 |

| Gross margin | 1,214 | 993 |

| Operating expenses: | ||

| Selling, general and administrative expenses | 471 | 451 |

| Research, development and engineering expenses | 270 | 258 |

| Amortization of purchased intangibles | 28 | 30 |

| Operating income | 445 | 254 |

| Interest income | 12 | 12 |

| Interest expense | -82 | -83 |

| Translated earnings contract (loss) gain, net | -101 | 39 |

| Other (expense) income, net | -34 | 74 |

| Income before income taxes | 240 | 296 |

| Provision for income taxes | -55 | -71 |

| Net income | 185 | 225 |

| Net income attributable to non-controlling interest | -28 | -16 |

| Net income attributable to Corning Incorporated | $157 | $209 |

The specialty glass and ceramics maker reported sales of $3.26 billion for Q1, hitting the high end of its guidance despite ongoing inventory adjustments by customers. The company improved gross margins by 160 basis points YoY to 36.8% and boosted free cash flow by $300 million.

“We continue to expect that the first quarter will be the lowest quarter for the year,” Chairman and CEO Wendell Weeks told analysts on the call.

Display Technologies posted Q1 sales of $872 million (up 14% YoY) and net income of $201 million (up 26% YoY), with stronger performance expected in Q2 as panel makers increase production.

“Panel makers increased their utilization rates late in the first quarter and we expect the higher utilization to continue into the second quarter driven by expected growth in retail demand resulting from mid-year promotions,” Weeks said.

The company highlighted the ongoing shift toward larger TV screens, noting that “sales of 85 inch TVs increased by more than 50% year-over-year” in Q1. For 2024, Corning anticipates flat television unit volumes but continued screen size growth and PC market recovery, resulting in “mid-single-digit percent growth in glass volume at retail versus 2023.”

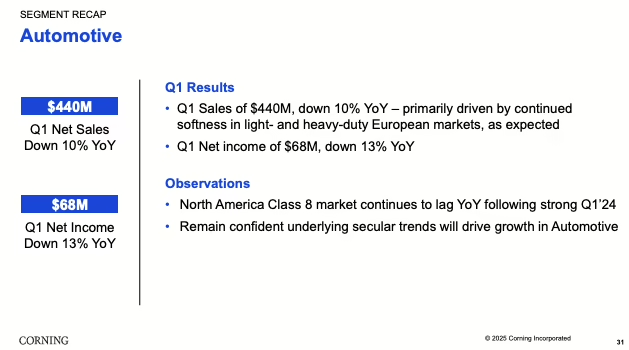

In automotive, Corning sees significant opportunity from new EPA emissions standards that will require gasoline particulate filters (GPFs) on US gasoline vehicles beginning with model year 2027. As the inventor and market leader in GPF technology, Corning projects this will increase its “environmental technology’s content opportunity by two to three times per US ICE vehicle.”

“This adoption offers hundreds of millions of dollars of growth for us in the US alone even in the phase of BEV adoption,” Weeks said.

The Environmental Technologies segment reported Q1 sales of $455 million (up 6% YoY) and net income of $105 million (up 28% YoY), driven primarily by “increased GPF adoption in China.”

For Q2, Corning guided for sales of approximately $3.4 billion, with free cash flow expected to improve sequentially by $300 million. The company maintained its capital expenditure projection of approximately $1.2 billion for 2024.

Chief Financial Officer Ed Schlesinger said the company is well-positioned to add “more than $3 billion in annualized sales within the next three years” while generating strong incremental profit with minimal additional investment, as “the required capacity, the technical capabilities are already in place and the costs are already in our financials.”