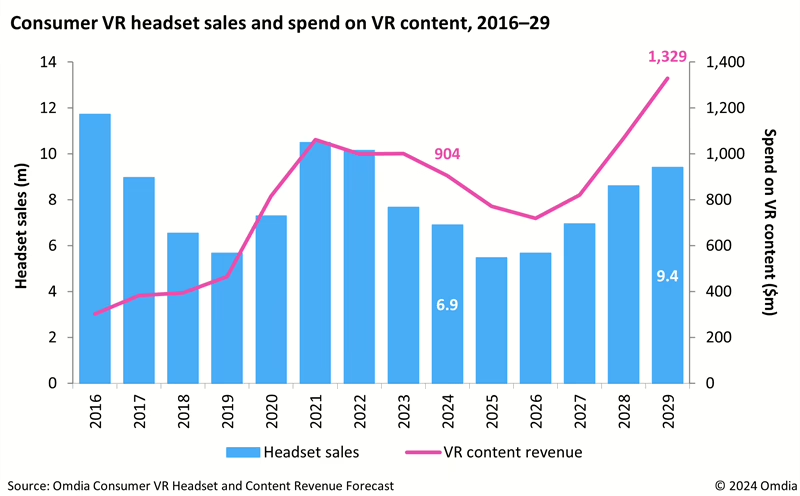

The consumer VR market continued its downward trajectory this year, with global headset sales falling by 10% to 6.9 million units, according to new data from Omdia. The research firm’s latest report points to a cooling interest in VR, despite the high-profile launch of Apple’s Vision Pro headset earlier in the year.

Early sales figures for Meta’s new Quest 3S are also falling short of expectations. With limited incentives for existing Quest 2 owners—over 20 million of whom have purchased the device since 2020—to upgrade, the total number of VR headsets in active use dropped 8% this year to 21.9 million. According to Omdia, this lack of enthusiasm, coupled with few must-have new titles, is undermining consumer confidence in VR’s long-term appeal.

Looking ahead, Omdia remains cautious. VR content spending stood at $904 million in 2024 and is forecast to climb to $1.3 billion by 2029—a respectable increase, but still modest compared to the console gaming sector’s $37.4 billion content spend this year. Growth, if it comes, is likely to hinge on two factors: Meta’s ongoing commitment to the category and the rumored introduction of a more affordable Apple Vision Pro model in 2026.

In the meantime, industry players are beginning to shift their focus away from bulky headsets and their pass-through mixed reality features. Instead, they are pinning hopes on lightweight augmented reality (AR) glasses designed for all-day, “anywhere” usage. The idea is that these smaller, more accessible devices—integrating spatial computing and multimodal AI—will gradually normalize head-worn tech. This, in turn, could lay the groundwork for a future VR revival.