34 million desktop monitors were shipped in Q4’14: an overall fall of 4.4% YoY, but 1.3% higher than IDC’s forecast. Western Europe, the second-largest monitor market worldwide, experienced positive growth of 8.4%.

Vendors focusing on the consumer space, like Samsung and LG, fuelled the category. Windows XP renewals also boosted shipments in both public and private sectors.

This year, IDC has predicted a 10.4% decline in Q1, to 30.3 million units. Around 123 million monitors will be shipped over the course of the year, falling to below 103.5 milion by 2019. IDC blames mobile device adoption for the declining shipments.

In technology terms, LED backlights continued to dominates with a 97.6% market share, rising 7.9 percentage points YoY. 21.x” remained the most common screen size, with a 22.5% share in Q4.

IDC expects monitors with TV tuners to grow 2.6% YoY this year, to a 6.5% market share (up from 5.8% in 2014), led by LG and Samsung; these companies have a combined share of 99% in this category.

| Worldwide PC Monitor Unit Shipments, Market Share and YoY Growth (Q4’14) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share | Q4’13 Market Share | YoY Change |

| Dell | 5,157,743 | 4,986,112 | 15.2% | 14.0% | 3.8% |

| Samsung | 4,299,545 | 4,172,108 | 12.7% | 11.7% | 3.1% |

| HP | 4,020,210 | 4,265,663 | 11.8% | 12.0% | -5.8% |

| Lenovo | 3,683,125 | 3,604,718 | 10.9% | 10.1% | 2.2% |

| LG | 3,128,175 | 3,438,066 | 9.2% | 9.7% | -9.0% |

| All Vendors | 13,653,061 | 15,071,014 | 40.2% | 42.4% | -9.4% |

| Source: IDC | |||||

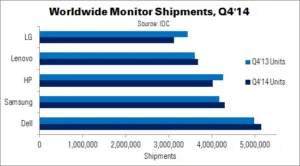

Dell led monitor shipments in Q4 with a 15.2% share. The vendor achieved growth in regions except Japan and LATAM. Samsung followed at number 2, with 3.1% YoY growth to 4.3 million units. Growth was positive in all of Samsung’s top regional markets.

HP reached an 11.8% share with shipments exceeding 4 million units. Although the company’s shipments rose 9.5% in Western Europe and 23.3% in LATAM, they were not enough to offset a YoY decline of 5.8% globally.

Lenovo shipped 3.6 million units (2.2% growth), with gains in five of the eight regional markets. Western Europe led, rising 27.5%. LG rounded out the top five with a 9.2% share. LG made its biggest gains in Western Europe (12.6%) and APACxJ (6.6%).