The global market for thin clients and terminal clients slipped 6.7% YoY in Q3’15 according to IDC. Shipments compared poorly to the strong results of 2014, and were also hampered by economic and currency pressures in key parts of the market.

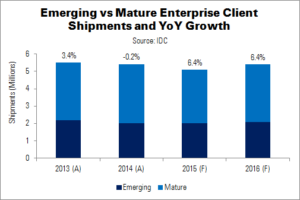

There were some persistent factors that continued to impede the client device market, such as budget constraints that delayed major shipments in APAC. In addition, emerging markets continued to lag behind mature markets in terms of both shipments and projected growth rates. Furthermore, although client devices are increasingly accepted, devices such as repurposed PCs, and even Chromebooks, are viable competitors.

IDC expects total 2015 shipments to be lower than previously forecast, reaching 5.1 million units: a fall of more than 6% YoY. A return to steady growth is expected in 2016 – 2019, reaching 6.4 million units by the end of the forecast.

| Worldwide Enterprise Client Device Unit Shipments, Share and Growth, Q3’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Shipments | Q2’15 Shipments | Q3’15 Share | Q2’15 Share | Q3’15/Q3’14 Change |

| HP | 339 | 319 | 26.9% | 25.0% | -8.2% |

| Dell | 327 | 301 | 26.0% | 23.6% | -10.6% |

| NComputing | 110 | 213 | 8.8% | 16.6% | -4.8% |

| Centern | 98 | 111 | 7.8% | 8.7% | 9.8% |

| Igel | 61 | 55 | 4.8% | 4.3% | -14.8% |

| Others | 323 | 278 | 25.7% | 21.8% | -4.0% |

| Total | 1,259 | 1,277 | 100.0% | 100.0% | -6.7% |

| Source: IDC | |||||