Shipments of enterprise (thin and terminal) client devices were down 6.8% YoY in Q4’15, says IDC – and a similar figure (6.9%) for the year as a whole. Many enterprise client projects faced cutbacks or delays, due to a faltering economic outlook and lower public budgets.

“While there was a certain amount of slowdown expected [in 2015,] as many organizations had just refreshed their systems a year or two ago, the extent of economic and currency-related issues had a definite impact in the budget and timeline of other projects which were supposed to be in the pipeline”, said IDC’s Jay Chou. “Nonetheless, awareness around VDI continues to improve, and IDC does expect an improved outlook ahead, especially as companies begin to think about moving beyond Windows 7.”

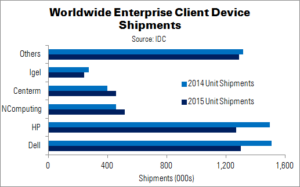

HP and Dell were virtually tied for first place, with a share difference of just 0.6%. NComputing, in third, rebounded from its recent limitations and rose above 12% volume growth. Fourth-place Centern also grew, thanks to some major financial project wins in China.

APACxJ was the world’s most successful enterprise client device market in 2015, growing more than 10%: the only region to see positive growth for the year.

| Worldwide Enterprise Client Device Unit Shipments, Share and Growth, 2015 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2014 Unit Shipments | 2015 Share | 2014 Share | YoY Change |

| Dell | 1,300 | 1,508 | 25.6% | 27.7% | -13.8% |

| HP | 1,272 | 1,497 | 25.0% | 27.4% | -15.0% |

| NComputing | 518 | 459 | 10.2% | 8.4% | 12.8% |

| Centerm | 457 | 398 | 9.0% | 7.3% | 15.0% |

| Igel | 243 | 276 | 4.8% | 5.1% | -12.1% |

| Others | 1,290 | 1,316 | 25.4% | 24.1% | -2.0% |

| Total | 5,080 | 5,454 | 100.0% | 100.0% | -6.9% |

| Source: IHS | |||||