TrendForce is reporting that global smartphone panel shipments are projected to dip slightly by 1.7% in 2025, with total shipments expected to reach approximately 2.032 billion units. While the smartphone market is anticipated to grow by a modest 3% in 2024, demand for refurbished and second-hand devices has bolstered panel shipments, which are estimated to increase by 6.7% YoY, hitting 2.066 billion units.

The smartphone market appears set to stabilize in 2025, with a gradual return to a traditional supply-demand balance expected, according to TrendForce. Although a slight reduction in demand for second-hand devices may ease some of the pressure on new shipments, overall smartphone panel demand is expected to decline modestly.

BOE continues to lead the market, with smartphone panel shipments expected to reach 593 million units this year. In 2025, BOE’s shipments are projected to rise by 2.8% to 610 million units, maintaining its position as the global leader. Samsung Display, the second-largest supplier, will see shipments near 376 million units in 2024. However, Apple’s anticipated supplier diversification may lead Samsung’s shipments to decrease by 3.1%, totaling around 365 million units in 2025.

HKC, ranking third among suppliers, is experiencing significant growth driven by the cost efficiency of its G8.6 production line, with a projected 4.8% increase from 219 million units in 2024 to 230 million in 2025. Fourth-ranked CSOT, benefiting from a partnership with Xiaomi, anticipates a slight rise from 191 million units in 2024 to 192 million in 2025. Tianma, holding fifth place, is expected to maintain stable shipments at 188 million units, balancing decreased LTPS LCD demand with a surge in AMOLED demand.

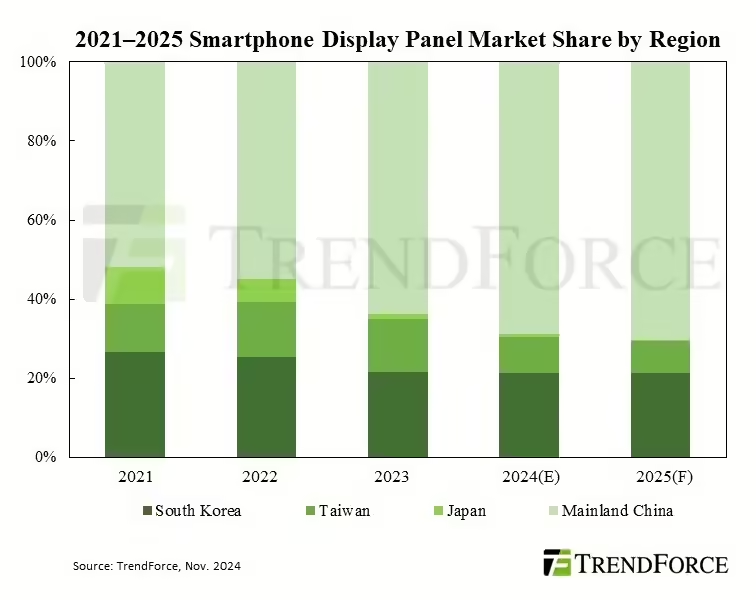

Regionally, Chinese manufacturers are gaining traction, particularly in the mid- to high-end AMOLED and low-end a-Si LCD markets. Their global market share is forecast to reach 68.8% in 2024, potentially surpassing 70% in 2025, underscoring their central role in the global smartphone panel supply chain. Taiwanese panel makers face increasing pressure from HKC’s rapid rise, while Japanese firms are gradually exiting the smartphone panel sector. Korean manufacturers, specializing in high-end AMOLED panels, continue to hold a competitive edge in the premium market with a steady 20-21% market share.