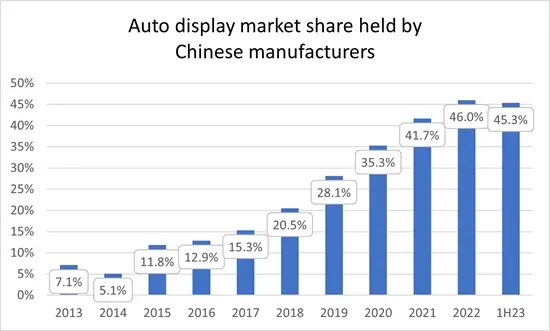

Chinese firms have marked a notable dominance in the automotive display sector in the first half of 2023, solidifying their leading position in the wider display industry, which includes the TV and smartphone markets. A recent report by Omdia says that Chinese companies now command a 45.3% market share, a dramatic rise from their 7.1% stake just a decade ago.

The two key players bolstering this growth are BOE and Tianma. Together, they account for 30.7% of the market, with BOE notably being the sole panel supplier with a market share exceeding 15%. BOE, with its significant production capacity from two Gen8.6 TFT LCD fabs and two Gen6 OLED fabs, offers affordable platform models and has cemented its leadership in center stack display and the aftermarket segment. Tianma, on the other hand, mainly specializes in a-Si LCD application and remarkably dominates the instrument cluster display segment with an impressive 24% market share.

Chinese suppliers, including BOE, HKC, Tianma, and CSOT, are anticipated to sustain high production capacities for automotive displays. Plans are underway for these firms to allocate a considerable portion of Gen8.x a-Si/Oxide LCD specifically for automotive applications. Both BOE and Tianma have intentions to repurpose more LTPS LCD capacity from the smartphone sector to automotive, following the lead of CSOT. Besides BOE and EDO, several other companies like Tianma, CSOT, and Visionox are also on track to produce OLED automotive displays and make inroads there, too.