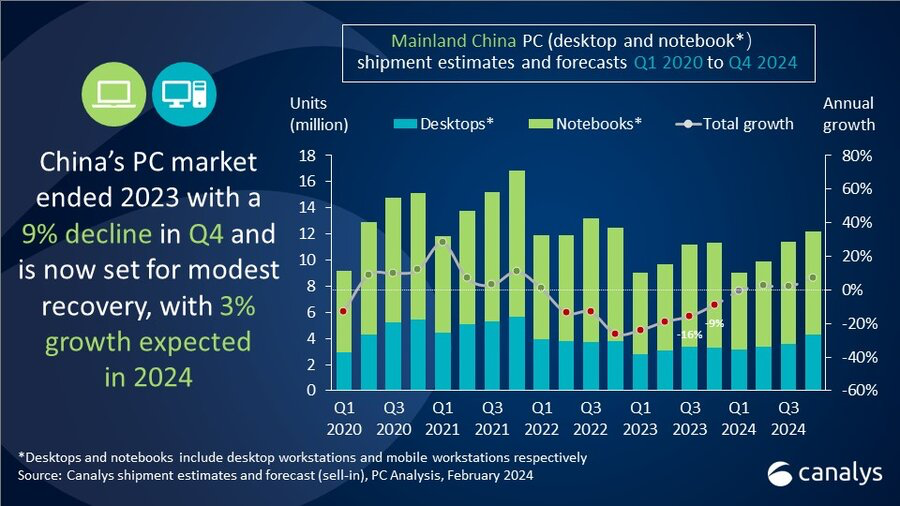

China’s personal computer (PC) market is set to rebound with 3% growth in 2024 and 10% growth in 2025, according to a new report from technology market research firm Canalys. The anticipated recovery will be primarily driven by refresh demand from the commercial sector.

The Canalys report also revealed that China’s PC market, excluding tablets, experienced a 9% year-on-year decline in the fourth quarter of 2023, with 11.3 million units shipped. Desktops saw a 13% drop to 3.3 million units, while notebook shipments decreased by 7% year-on-year to 8.1 million units. Overall, PC shipments in 2023 totaled 41.2 million units, a 17% decrease from 2022.

| Segment | 2023 shipments | 2024 shipments | 2025 shipments | 2024 annual growth | 2025 annual growth |

|---|---|---|---|---|---|

| Consumer | 23,390 | 23,679 | 25,476 | 1% | 8% |

| Commercial | 17,210 | 18,186 | 20,742 | 6% | 14% |

| Education | 640 | 621 | 656 | -3% | 6% |

| Total | 41,240 | 42,486 | 46,874 | 3% | 10% |

| Vendor (company) | 2023 shipments | 2023 market share | 2022 shipments | 2022 market share | Annual growth |

|---|---|---|---|---|---|

| Lenovo | 15,536 | 38% | 19,253 | 39% | -19% |

| HP | 4,309 | 10% | 4,380 | 9% | -2% |

| Huawei | 3,986 | 10% | 3,576 | 7% | 11% |

| Dell | 3,148 | 8% | 5,644 | 11% | -44% |

| Asus | 2,863 | 7% | 3,770 | 8% | -24% |

| Others | 11,399 | 28% | 12,876 | 26% | -11% |

| Total | 41,240 | 100% | 49,499 | 100% | -17% |

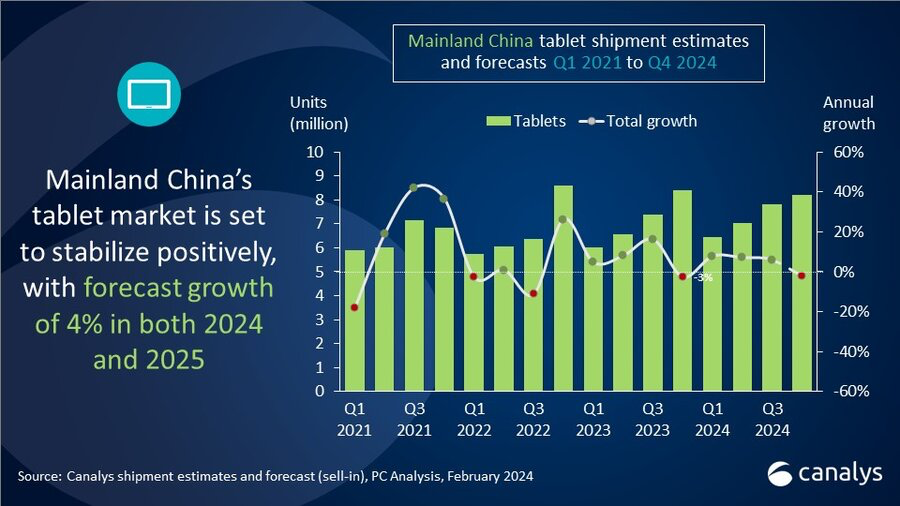

The tablet market in China is also expected to experience growth, with Canalys projecting a 4% increase in both 2024 and 2025. This growth is attributed to increasing penetration as digitalization deepens in the country.

China’s tablet market also faced a decline of 3% in Q4 2023, reaching 8.4 million units. Full-year 2023 tablet shipments amounted to 28.3 million units, amid increased competition as new entrants ramped up their focus on the category.

| Segment | 2023 shipments | 2024 shipments | 2025 shipments | 2024 annual growth | 2025 annual growth |

|---|---|---|---|---|---|

| Consumer | 23,755 | 25,187 | 26,441 | 6% | 5% |

| Commercial | 3,731 | 3,495 | 3,448 | -6% | -1% |

| Education | 836 | 843 | 802 | 1% | -5% |

| Total | 28,322 | 29,524 | 30,691 | 4% | 4% |

| Vendor (company) | 2023 shipments | 2023 market share | 2022 shipments | 2022 market share | Annual growth |

|---|---|---|---|---|---|

| Apple | 8,995 | 32% | 10,029 | 37% | -10% |

| Huawei | 6,460 | 23% | 3,924 | 15% | 65% |

| Xiaomi | 3,267 | 12% | 3,811 | 14% | -14% |

| HONOR | 2,999 | 11% | 2,374 | 9% | 26% |

| Lenovo | 2,316 | 8% | 2,249 | 8% | 3% |

| Others | 4,286 | 15% | 4,376 | 16% | -2% |

| Total | 28,322 | 100% | 26,764 | 100% | 6% |

Despite the positive outlook, Canalys Analyst Emma Xu cautioned that challenges will persist in the market. “2024 is expected to bring modest relief to a struggling PC market in China, but a challenging environment will remain,” she said.

Xu highlighted that the Chinese government’s focus on technology-driven innovation and the establishment of a domestic AI ecosystem across industries could present significant opportunities for the PC industry. This commercial push coincides with an upcoming device refresh cycle and the emergence of AI-capable PCs.