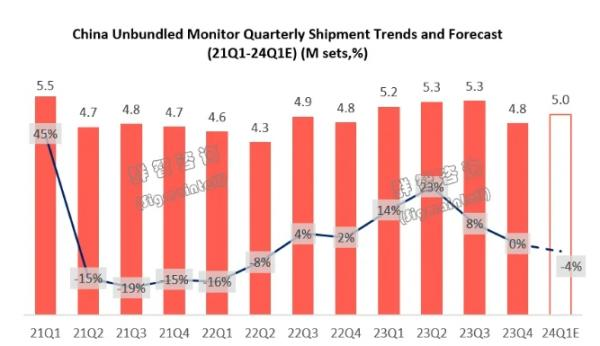

China’s monitor market is heading for a lackluster start to the year as the industry moves into a period of rebalancing, with shipments expected to drop 3.8% in the first quarter, according to research firm Sigmaintell.

The market, which saw strong growth in 2023 on the back of falling component costs and aggressive price competition, is now grappling with rising expenses and high channel inventories. This has prompted brands to dial back on their low-price strategies and focus on profitability, the firm said.

Shipments are projected at around 5 million units in the first three months, down from both the previous quarter and year-ago period. For the full year, the market is forecast to see a slight contraction of about 1% to 20.5 million units.

While international brands such as AOC and Philips are seen regaining some lost share thanks to their more stable supply chains, the report noted that the top five vendors — which also include Lenovo, HKC and Xiaomi — will likely consolidate their dominance as they hit a bottleneck in terms of scale.

In terms of new technologies, OLED monitors are expected to nearly double shipments to around 100,000 units this year as brands expand their high-end gaming lineups. Mini LED displays are also seen growing, particularly in the domestic Chinese market, though their global uptake may be hindered by a lack of standardization and high costs, the firm said.

Sigmaintell said that while a drop in overall volumes would be less than ideal, the shift away from cutthroat price wars would benefit the industry in the long run by improving profit margins and encouraging investment in new products. The key challenge for brands will be to refocus on “product value” and explore fresh applications to reignite replacement demand among consumers in the era of AI..