| Metric/Key Data Point | 2024 Performance |

| Market Size | $252 million |

| Year-over-Year Growth (2023-2024) | 58% |

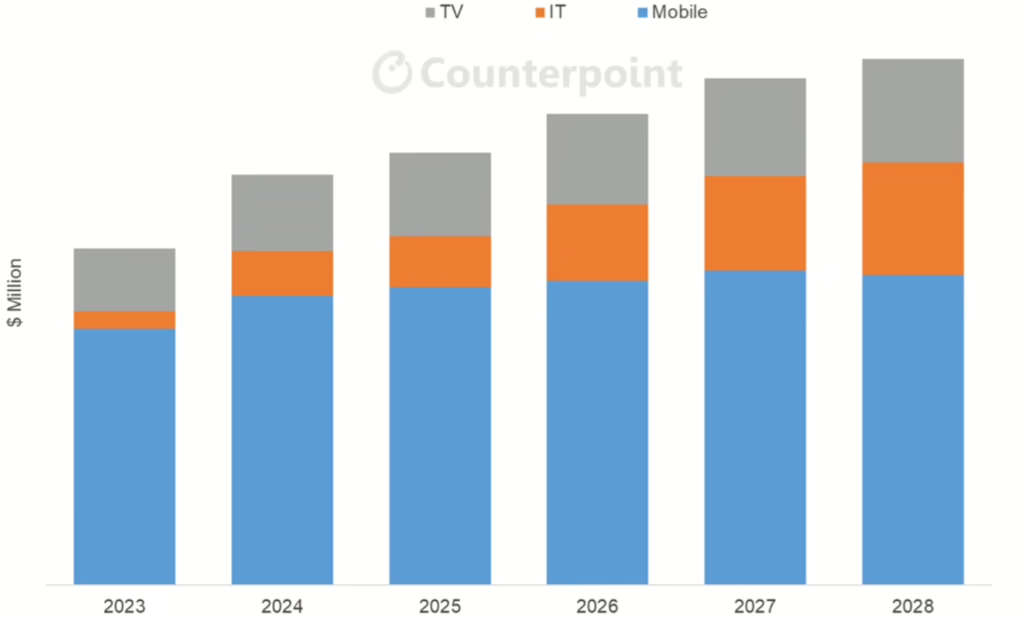

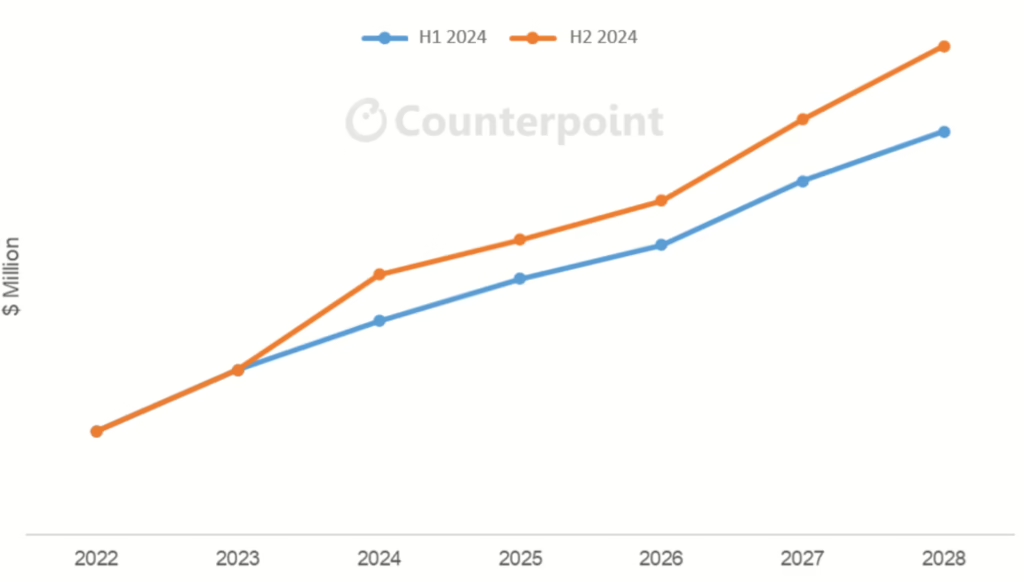

| Revenue Growth for All Applications | 22% |

| Compound Annual Growth Rate (2024-2028) | 6.40% |

| Leading Domestic Suppliers | Jilin OLED, LTOM, Summer Sprout |

| Notable Market Trends | Increased supply of R/G/B emitting materials and p-dopants |

| Domestic Market Share | Most materials used locally |

| Competition | Performance gap narrowing with global suppliers |

The China AMOLED evaporation materials market has seen substantial growth in 2024, with market size reaching $252 million, reflecting a 58% year-over-year increase. This growth is attributed to several factors, including higher utilization rates among Chinese AMOLED panel makers and an increased input area for production. Additionally, the sourcing of materials from local suppliers has expanded significantly, with domestic manufacturers enhancing their supply of high-value components such as R/G/B emitting materials and p-dopants.

According to Counterpoint (nee DSCC) revenues for AMOLED evaporation materials across all applications are projected to grow by 22% year-over-year in 2024, with a compound annual growth rate of 6.4% anticipated from 2024 to 2028. The report highlights the critical role played by Chinese local suppliers like Jilin OLED, LTOM, and Summer Sprout in driving the market forward. Summer Sprout, in particular, has emerged as a notable player, recently supplying green dopants and p-dopants to BOE, marking a shift away from reliance on global suppliers like UDC and Novaled.

The narrowing performance gap between local and global suppliers is fostering intense competition in the AMOLED materials sector, with Chinese manufacturers gaining a stronger foothold both domestically and internationally. While most materials from local suppliers currently serve the domestic market, the growing capability of these manufacturers to produce high-value components positions them as key players in the industry. The report also suggests that as local suppliers continue to improve their performance, the competition with global suppliers targeting Chinese panel makers will become even more pronounced.