According to International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker, 27 million smartphones were shipped in India in CY Q1 2017 with a healthy 14.8 percent growth over the same period last year. But unlike last year, shipments grew sequentially in the first quarter of 2017 by 4.7 percent recovering from demonetization impact in Q4 2016.

China-based vendors continue to strengthen their grip in Indian smartphone market. In the first quarter of 2017, China-based vendors captured 51.4 percent share of the smartphone shipments in India with 16.9 percent sequential growth and impressive 142.6 percent growth over the same period last year. In contrast, share of homegrown vendors dropped to 13.5 percent in the Q1 2017 from 40.5 percent in Q1 2016.

Increasing dominance of China-based vendors is resulting in a few new trends in India:

• ASP (Average selling price) of smartphone has increased from US$131 in Q1 2016 to US$155 in Q1 2017. Almost two-third smartphones sold by China-based vendors are in the price range of US$100-U$200 in India. It has shifted the mass segment which used be the less than US$100 to US$100-U$200 in India contributing almost half of smartphone shipments in Q1 2017

• 94.5 percent smartphones shipped in Q1 2017 were 4G-enabled. While home-grown companies had half of their portfolio in 3G in Q1 2016, China-based vendors were already bringing majority of devices in 4G segment which benefitted them in leveraging the 4G wave demand in India.

• Almost 5 out of 10 smartphones shipped in Q1 2017 had 13 Megapixel and more as primary/rear camera. While the 62.2 percent of devices shipped by China-based vendors are equipped with 13 Megapixel and more as primary camera.

• The share of less than 5 Inch screen size smartphone reduced to 21.2 percent in Q1 2017 from 40.3 percent in Q1 2016. The focus of China-based vendors remains on bigger screens, 9 out of 10 smartphones shipped by China-based vendors were 5 inch and above in Q1 2017.

• For the first time, in the first of quarter of 2017, a smartphone model from a China-based vendor became the highest shipped smartphone as Redmi Note 4 replaced Samsung Galaxy J2 which was the top model in Q4 2016.

• Direct internet channel (Vendor selling from their website) captured 4% market share in Q1 2017 from the negligible share in Q12016. Xiaomi’s efforts for operating the Mi.com and frequent short supply of its devices with eTailers were the key reasons for the shift of Indian consumers buying from vendor website.

“Though homegrown vendors are making attempts to recapture the lost ground with new launches in sub-US$100 as well as in the mid-range segment. But intense competition from China-based vendors continues to be a major challenge and is expected to increase in coming quarters” says Jaipal Singh , Market Analyst, Client Devices, IDC India. “Recovery of homegrown vendor is necessary for Indian smartphone market not only to fill-in the vacuum created for last few quarters but also to fuel the feature phone to smartphone migration” added Singh

Online channel shipments grew by 7.7 percent in Q1 2017 over the same period last year. “Over the time, online channel has established itself as a prominent distribution medium in Indian smartphone market with a stable contribution of almost one-third of total shipments for last few quarters. Interestingly, online channel has relatively higher shipments of smartphones with superior features in comparison to the offline channel”, says Karthik J , Senior Market Analyst, Client Devices, IDC

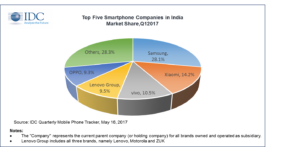

Samsung saw 16.9 percent sequential growth in the first quarter of the 2017; enabling it to maintain the leadership position in Indian Smartphone market. Shipments grew year-on-year by 21.7 percent. Multiple new launches in Q1 2017 across price bands with J2 series additions, C9, A-series (2017 versions), etc. incrementally contributed over a million units to the already successful Samsung’s product line up.

Xiaomi secured 2nd place with healthy 39.8 percent sequential growth in Q1 2017 over previous quarter. Two new launches – Redmi Note 4 and Redmi 4A, in the first quarter of the year not only drove the volume growth for Xiaomi but also helped vendor to lead online smartphone shipments with 40.6 percent share.

vivo climbed up to 3rd place in Q1 2017 compared to its presence outside the Top 10 in the same period last year. Its shipments grew 44.2 percent over Q4 2016 to secure 10.5 percent vendor share. All the new launches from this brand were targeted towards strengthening >US$150 segment which is expected to be a high growth segment this year.

Lenovo (including Motorola) slipped to 4th as its shipments remained flat over previous quarter. However, shipments grew at a healthy 33.7 percent over Q1 2016. Contribution from retail and expansion of its presence in the offline channel has been challenging for the vendor since last few quarters.

OPPO stands close to Lenovo group in vendor share but at 5th position. Shipments grew by 14 percent in Q1 2017 over the previous quarter and more than doubled over the same period last year. While OPPO’s online shipments saw marginal traction through its exclusive launches, it continues to be focused on the offline channel with aggressive marketing and channel support.

Overall mobile phone market shipments in Q1 2017 was 56.6 million units with a marginal sequential dip of 3.2 percent. Feature phones registered 29.7 million units in Q1 2017 with a 9.4 percent decline over previous quarter. While feature phone market remained flat over the same period last year, healthy growth from smartphones resulted in overall mobile phones market to post 6.5 percent growth in Q1 2017.

IDC India Forecast:

Channel players in the smartphone distribution set up are taking a cautious approach regarding procuring the inventory for the second quarter due to expected implementation of GST from 1st July 2017. “Apprehensions on lower tax credit and lack of complete clarity regarding the processes are the major concerns of retailers and city/state level distributors, which may lead to a limited inventory stocking, especially in the second half of June 2017” says Navkendar Singh , Sr. Research Manager, IDC India, ”But this impact is expected to short lived as market is likely to attain normalcy in few months.”