Tablet shipments in the Central and Eastern Europe (CEE) sub-region were down 21.4% in Q2’15, compared to Q2’14, says IDC. 2.8 million units were shipped.

2-in-1 (hybrid) devices experienced the greatest annual decline, with shipments falling 38.6%. Despite this, IDC writes that the share of hybrid devices in the overall tablet market has remained steady (2% – 3%), and that the form factor will grow ‘gradually’ in the coming years – cannibalising some notebook share.

Average tablet selling prices were down 21.9% YoY in Q2. This is consistent with the trend of recent years, which have shown at average decline of 25%. The market is showing “clear signs of saturation”, said IDC’s Jiří Teršel.

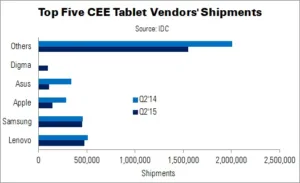

Lenovo led the CEE tablet market, regaining its leading position after a lack of success in Q1. Share rose 2.8 percentage points, with shipments of 480,000 devices. Lenovo’s performance has increasingly been set again that of rival Samsung, in recent years. Their combined market share was 32.7% in Q2, up from 26.9% in Q2’14 and 20.1% in Q2’13.

Samsung followed Lenovo closely, with 450,000 units shipped and a 3.2 percentage point rise (to 15.9%). Apple’s share, however, fell to just 5% of the CEE tablet market. Due to Russia’s unstable climate, demand for iPads in the country was roughly half that of the Czech Republic. The Czech market represented about 25% of Apple’s CEE tablet sales in Q2. The strength of the US dollar also hurt the company’s performance.

Asus had a 3.9% market share on shipments of 100,000 units – about 30,000 units behind Apple in volume terms. However, in value terms Asus took only about 33% of Apple’s revenues.

A newcomer to the CEE top five is Digma, a local brand focusing on low-end devices. Digma shipped 100,000 units, with a 3.5% market share. 80% of its devices had a screen size below 9″.

“Tough competition…steadily declining prices, and efficient mass production, all contribute to a deflationary market”, said Teršel.