CCS Insight has raised its near-term forecast for global 5G connections following impressive progress made by the industry over the past six months. This headway has been accelerated by agreement on standards, trials, deployment of chipsets and infrastructure, and operator commitments to the technology.

A significant milestone was the ratification of the non-standalone specifications for 5G in late 2017. It paved the way for an encouraging start to 2018 that saw a flurry of operators—mostly in developed US and Asian markets—target commercial deployment in 2019. In fact, the fierce race to be first could see initial commercial 5G services appear as soon as late 2018 in the US, albeit on a limited scale.

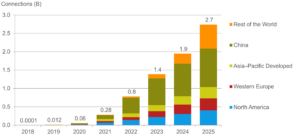

The firm estimates total global 5G connections in 2020 at almost 60 million, rising more than 50% on its previous prediction. It also presents a stronger outlook for 2021 at 280 million connections—a 25% improvement. Changes in the latter years are more moderate; CCS still expects the 1 billion mark to be breached in mid-2023 and its projection for 2025 has inched up to 2.7 billion. Principal analyst Kester Mann commented:

“The industry might be struggling to establish the business models for investment in 5G but this isn’t stopping leading operators battling for bragging rights to launch the first networks. Competitive forces and the need for capacity are the leading drivers of early deployment, although we caution this could set unrealistic expectations for initial network capability”.

After early launches in South Korea, Japan and the US, CCS sees China quickly taking the lead in 5G. It will hit 100 million connections in 2021 before passing 1 billion in 2025. Despite most other markets having launched commercial services by 2025, China will still account for nearly four in every 10 global 5G connections.

The rising 5G tide is also reflected in the firm’s forecast for Western Europe. The region is expected to pass 100 million connections in early 2023. However, although some operators appear to be showing more appetite for 5G, notably Telia and Telecom Italia, the region appears further adrift of the leading markets than ever before. It continues to be hindered by market fragmentation, lack of scale, increasing regulation and operators’ preference to focus on 4G networks.

Autonomous driving and remote healthcare are still being touted as “killer” applications for new 5G networks, but CCS predicts adoption will be pushed by the growing need for higher speeds and bandwidth to support video consumption on mobile devices. The forecast shows that even in 2025, mobile broadband will still represent 98% of all 5G connections.

As such, adoption of 5G will be closely linked to availability of handsets. VP of Forecasting Marina Koytcheva concluded:

As such, adoption of 5G will be closely linked to availability of handsets. VP of Forecasting Marina Koytcheva concluded:

“We see the first 5G smartphones emerging in 2019 but these will be relatively few in number. The real ramp-up will come in 2021, when over 350 million 5G handsets will be sold worldwide”.

(Source: CCS Insight)

Analyst Comment

The impact of the developments in China and the scale of its economy are very clear in this chart. There was a time when such a technology breakthrough would have been driven by the US, Europe or Japan, but no longer! (BR)