In 2024, BOE reported total revenue of ¥198.38 billion ($27.75 billion), marking a 13.66% YoY increase from ¥174.54 billion ($24.41 billion) in 2023. The company’s net profit attributable to shareholders surged to ¥5.32 billion ($744.51 million), reflecting a 108.97% YoY growth. When non-recurring items are excluded, net profit improved significantly from a ¥632 million ($88.47 million) loss in 2023 to a profit of ¥3.84 billion ($536.66 million) in 2024. Operating cash flow was also strong, increasing by 24.64% to ¥47.74 billion ($6.68 billion). These numbers signal a return to growth, particularly after a challenging 2023. BOE’s return on equity (ROE) rose to 4.05% from 1.89% the previous year, supported by a stable asset base and improved operational efficiency. Total assets reached ¥429.98 billion ($60.14 billion), and shareholders’ equity increased modestly to ¥132.94 billion ($18.59 billion).

| Financial Metric | 2024 (CNY) | 2023 (CNY) | 2024 (USD) | 2023 (USD) |

|---|---|---|---|---|

| Total Revenue | 198,380,605,661 | 174,543,445,895 | 27,745,539,253 | 24,411,670,755 |

| Net Profit (Attributable to Shareholders) | 5,323,248,974 | 2,547,435,360 | 744,510,346 | 356,284,666 |

| Net Profit (Excluding Non-Recurring Items) | 3,837,124,867 | -632,561,344 | 536,660,821 | -88,470,118 |

| Net Cash from Operating Activities | 47,737,577,379 | 38,301,826,884 | 6,676,584,249 | 5,356,898,865 |

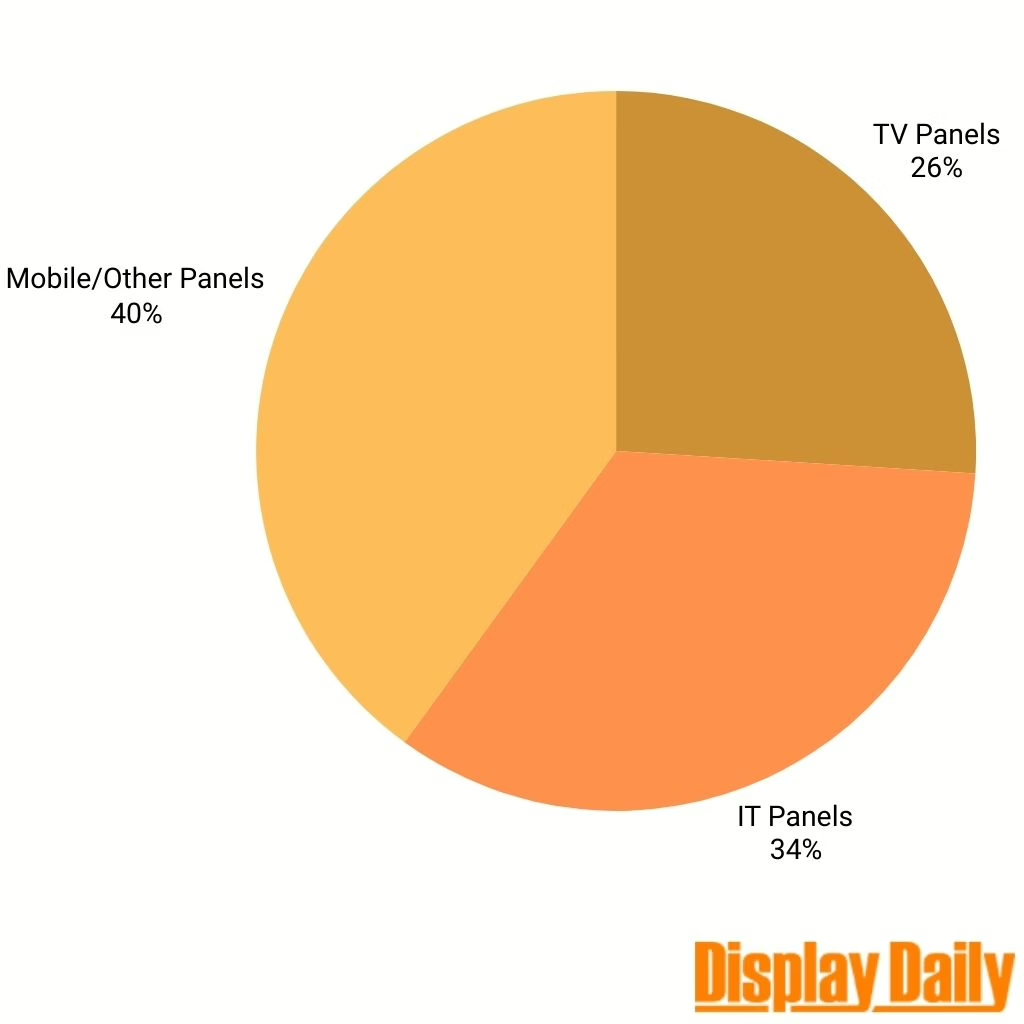

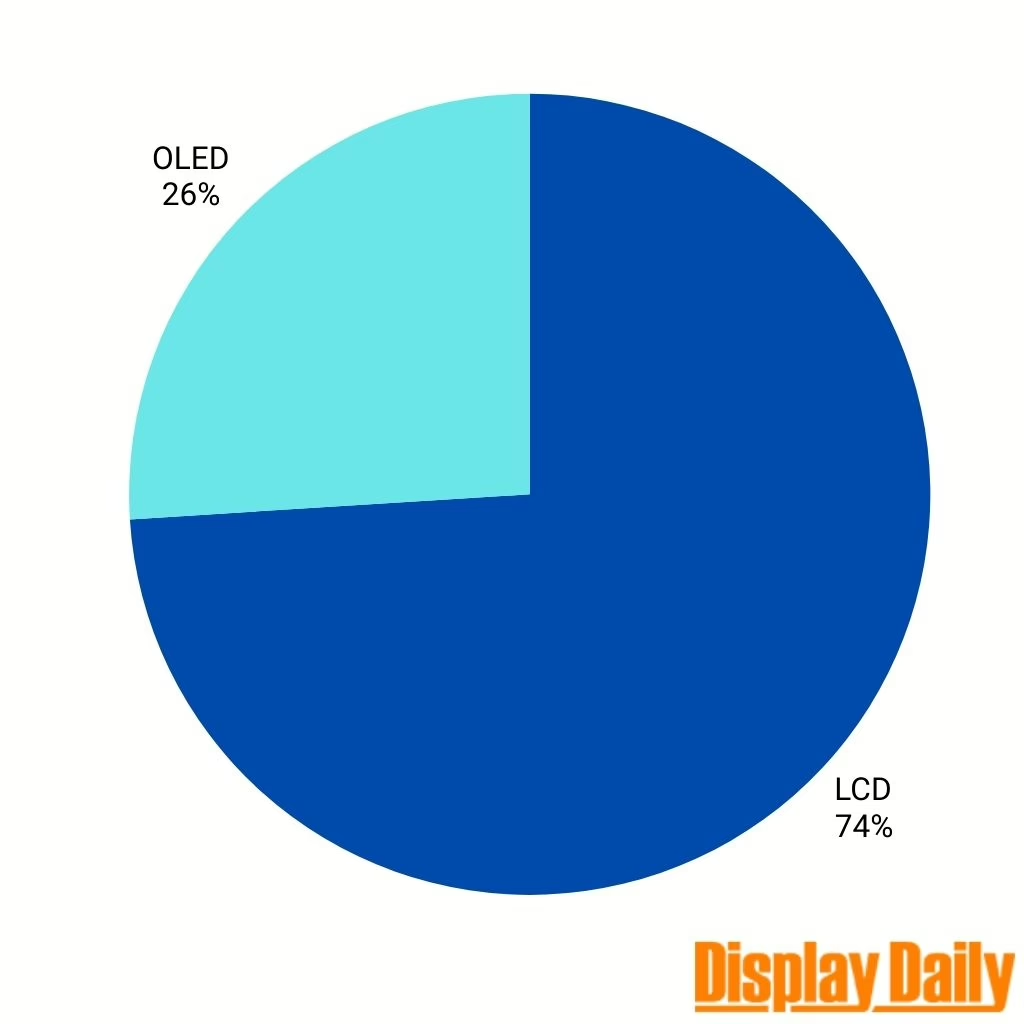

Segment-wise, display devices remained BOE’s core revenue generator, contributing ¥165 billion ($23.08 billion), or 83.2% of total revenue. IoT innovation added ¥33.83 billion ($4.73 billion), while MLED revenue rose sharply by nearly 50% to ¥8.48 billion ($1.19 billion). Although the sensor business saw a slight decline of 4.58% YoY, and medical engineering posted moderate growth at 9.73%, these figures affirm the company’s steady diversification. The display business saw notable revenue composition, with TV panels comprising 26%, IT displays 34%, and mobile and other devices 40%. OLED revenue accounted for 27% of the display business. Geographically, BOE derived 50.2% of its revenue from mainland China, a 23.6% YoY increase, while overseas markets contributed 49.8%, up 5.2%.

The company also invested heavily in innovation, with R&D expenditures reaching ¥13.12 billion ($1.83 billion) in 2024, a 15.94% increase, amounting to nearly 7% of total revenue. This spending supported advanced technology projects such as UB Cell, Oxide TFTs for low power consumption, and multiple OLED panel innovations including tandem structures and ultra-narrow bezels. The successful commercialization of the world’s first Z-shaped tri-fold OLED and a 110-inch 16K naked-eye 3D display underscores BOE’s continued leadership in advanced display technology.

According to BOE’s April 2025 investor Q&A, recent market conditions reflect shifting trends. The Chinese “trade-in renewal” stimulus helped stimulate LCD TV demand in Q1 2025, driving a short-term price recovery across mainstream sizes. However, this trend has begun to stabilize in Q2 as policy effects diminish and global trade uncertainties mount. BOE noted that LCD TV panel prices are expected to plateau, while IT panels (such as those for monitors) may continue to see modest price increases. Average industry-wide LCD capacity utilization has risen since November 2024, surpassing 80% in Q1 2025, but panel manufacturers are expected to adjust utilization more flexibly in Q2 to align with softened demand and adhere to just-in-time production models.

BOE’s flexible AMOLED business shipped approximately 140 million units in 2024 and has set a target of 170 million units for 2025. BOE is also expanding into mid-sized applications, such as automotive and IT panels. Although the business remains under margin pressure due to depreciation and market competition, the scale and technological leadership position BOE for stronger performance as market conditions stabilize.

The company incurred ¥38 billion ($5.31 billion) in depreciation in 2024, a figure slightly higher than the prior year due to the capitalization of several OLED lines, including Chengdu (B7), Mianyang (B11), and Chongqing (B12). BOE’s four major 8.5-generation LCD lines in Beijing, Hefei, Chongqing, and Fuzhou have fully depreciated, which is expected to result in more stable depreciation costs in 2025 and 2026. BOE’s capital expenditures are shifting from large-scale LCD capacity expansion to strategic investments aligned with its “Screen of Things” strategy. Future spending will focus on semiconductor display core upgrades, as well as innovation in IoT, sensing technologies, MLED, and healthcare engineering.

Operational efficiency has also improved, with non-R&D operating expenses falling by 0.4% YoY, reflecting disciplined cost control amidst revenue growth. Meanwhile, BOE remains committed to shareholder value, implementing a predictable return policy that includes cash dividends and share buybacks. Although no definitive announcement was made, BOE acknowledged that it may opportunistically repurchase minority interests in its high-generation fabs, depending on financial conditions.

BOE continues to build on its global intellectual property portfolio, having surpassed 100,000 total patent applications. Over 90% of new filings in 2024 were invention patents, with more than 33% filed internationally. BOE has maintained its position in the IFI global top 20 for U.S. patent grants for seven consecutive years and has remained in the top 10 for WIPO PCT applications for nine years. In support of long-term competitiveness, the company has also launched its “AI+” strategy, aiming to integrate artificial intelligence across manufacturing, product innovation, and operational management.