Global automotive display panel shipments reached 232 million units in 2024, a 6.3% YoY increase. According to Omdia, this rise was spurred by surging demand for advanced cockpit displays, especially in China, where head-up displays (HUDs), and room mirrors have gained traction.

China’s push for new energy vehicles has played a central role in this growth. Chinese-brand electric vehicles have found success both domestically and abroad, helped by policies that boost locally produced components and tighten China’s grip on the global supply chain. Many international automakers have shifted toward localized strategies to comply with government directives and contend with a highly competitive market. Chinese panel manufacturers achieved a collective market share exceeding 53% in 2024.

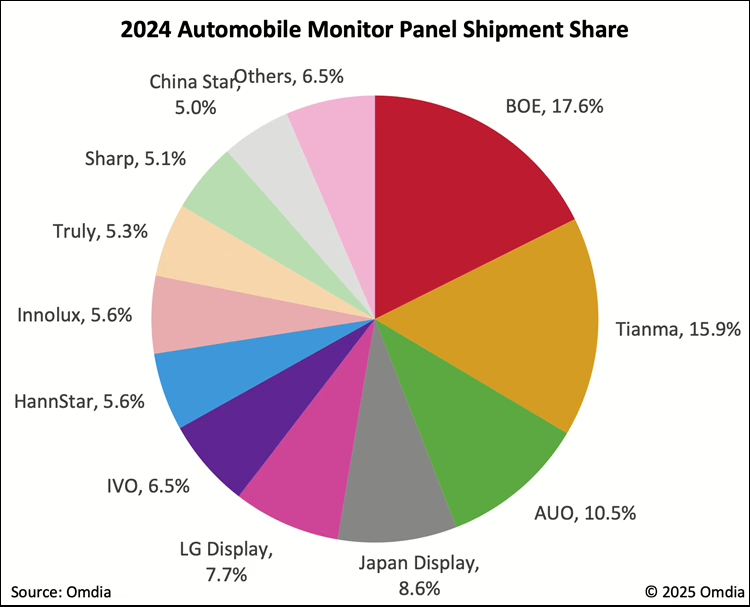

BOE led the sector with a 17.6% share and 40.9 million units shipped meaning 16% YOY growth. Tianma followed at 15.9% with 36.9 million units, posting the fastest growth among the top five at 25%. AUO claimed third place with 10.5% and shipped 24.4 million units, a 5% increase. JDI finished fourth at 8.6% but saw shipments drop by 13%, suggesting more difficulties for the company as it struggles to stay competitive. LG Display ranked fifth with 7.7% and 17.98 million units shipped or 8% YoY growth.

Outside the top five, IVO accounted for 6.5% of the market, up 20%, and Truly held 5.3%, up 4%. TCL CSO) made a significant leap of 125% to reach 5.0% share. Other suppliers posted declines as competition heated up

Omdia says, the industry landscape has forced some manufacturers to close small and mid-sized production lines. JDI’s announcement to shut down its Tottori and Mobara plants signals a broader shift toward cost-effective, high-capacity manufacturing. Omdia expects LCD fab capacity for automotive displays to increasingly concentrate in advanced production lines such as G6 LTPS and G8 a-Si or oxide fabs in China. Although these changes promise greater production efficiency, they also introduce new challenges for supply chain diversification, particularly as automakers and tier 1 suppliers contend with a complex global trade environment.