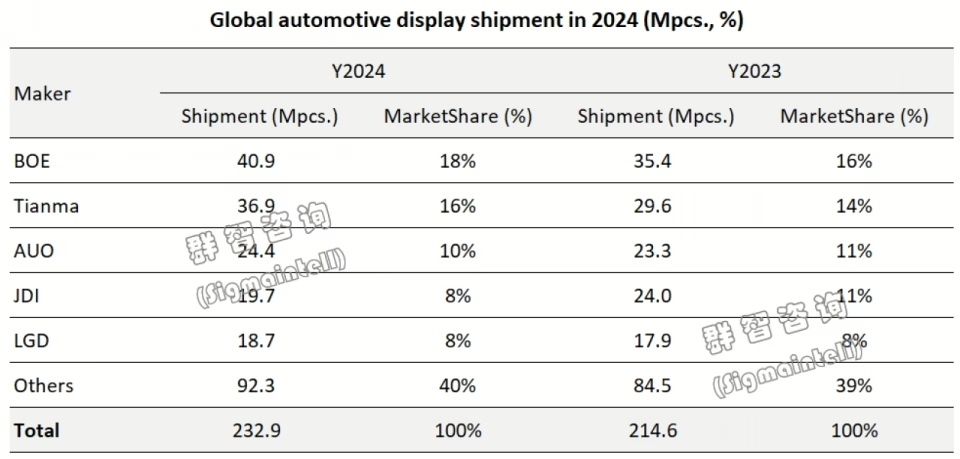

The automotive display panel market continues to expand, according to Sigmaintell, with global shipments forecast to reach 230 million units in 2024, an 8.5% YoY increase. Global vehicle display shipments are forecast to reach 245 million units in 2025, a 5.4% increase.

LG Display shipped 18.7 million vehicle displays (8.0% market share) last year, securing 5th place in the industry, a 4.5% increase from 17.9 million units (8.3% market share) in 2023. This growth fell below the global vehicle display market growth rate and, as a result, the company’s market share slightly decreased from 8.3% to 8.0%.

While amorphous silicon (a-Si) LCD displays dominate the global vehicle display market as lower-end products, SigmaIntel says LG Display leads in high-end markets with LTPS LCD and OLED technologies. The company has minimal a-Si LCD production, focusing instead on LTPS LCD and OLED displays.

Vehicle OLED shipments more than doubled last year to 2.6 million units, with Samsung Display leading at 1.4 million units. MiniLED display shipments increased 41.2% to 1.2 million units, targeting mid-to-high-end vehicles.

BOE topped the global vehicle display market with 40.9 million units (17.6% share), followed by Tianma (36.9 million, 15.9%), AUO (24.4 million, 10.0%), JDI (19.7 million, 8.5%), and LG Display (18.7 million, 8.0%). Despite global economic uncertainties, vehicle display shipments increased due to automotive intelligence advancements and EV growth.

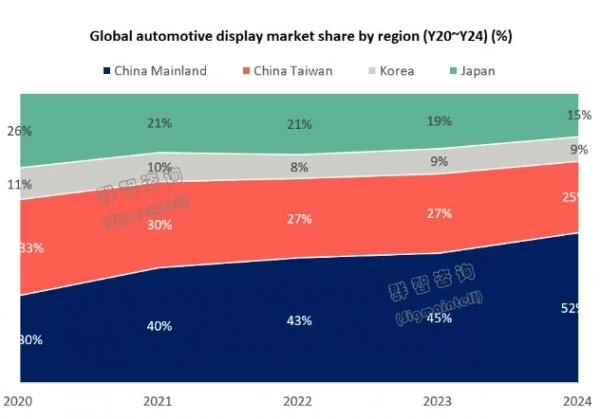

Chinese manufacturers accounted for 51.7% of total vehicle display shipments in 2024, exceeding 50% for the first time, benefiting from China’s electric vehicle expansion. SigmaIntel projects that display technology improvements combined with AI and connectivity advancements will improve smart device integration and personalized user experiences, with trends toward larger, curved, non-rectangular, and integrated solutions.