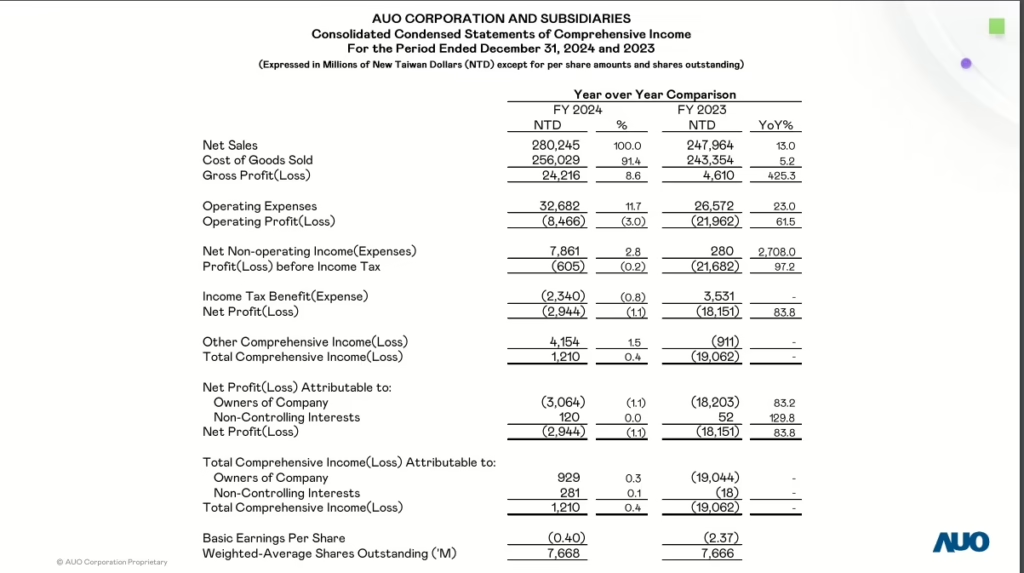

AUO announced its Q4 and full-year 2024 results, reporting Q4 revenues of NT$68.69 billion ($2.29 billion), which fell 11.6% QoQ but increased 8.4% YoY. The quarter saw an operating loss of NT$3.32 billion ($111 million) and a net profit of NT$1.62 billion ($54 million), while margins stood at 7.9% for gross, -4.8% for operating, and 6.9% for EBITDA.

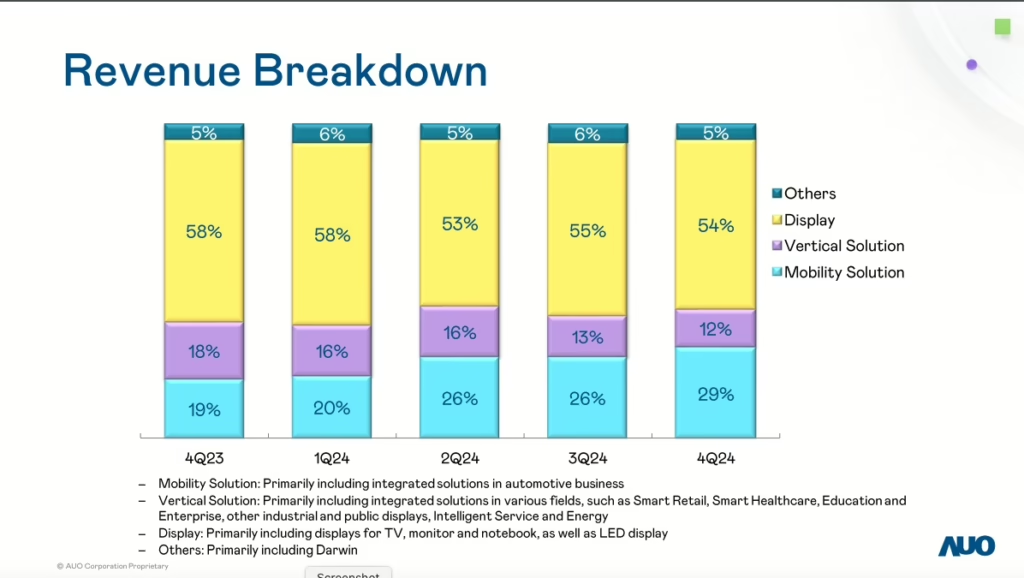

For the full year, revenues reached NT$280.25 billion ($9.34 billion), representing 13.0% growth YoY, although the company recorded an operating loss of NT$8.47 billion ($282 million) and a net loss of NT$3.06 billion ($102 million); the gross, operating, and EBITDA margins were 8.6%, -3.0%, and 9.1%, respectively. This revenue growth was driven by organic expansion in the display and mobility (automotive) solution segments, along with the addition of BHTC’s revenue from April 2024, even as the vertical solution business experienced a decline due to challenges in the Energy sector despite steady gains in display-centric solutions.

The company returned to profitability in Q4 with non-operating gains from the disposal of fabs, and overall operating performance improved compared to the previous year, as evidenced by enhanced gross and EBITDA margins and a narrowed net loss.

Looking ahead to 2025, AUO expects a balance in its display business, higher visibility in the mobility solution segment, and further growth in the vertical solution business. It remains committed to strategic transformation by focusing on mobility and vertical solutions to reduce the impact of panel industry cyclicality and to achieve stable long-term profitability despite global economic uncertainties.