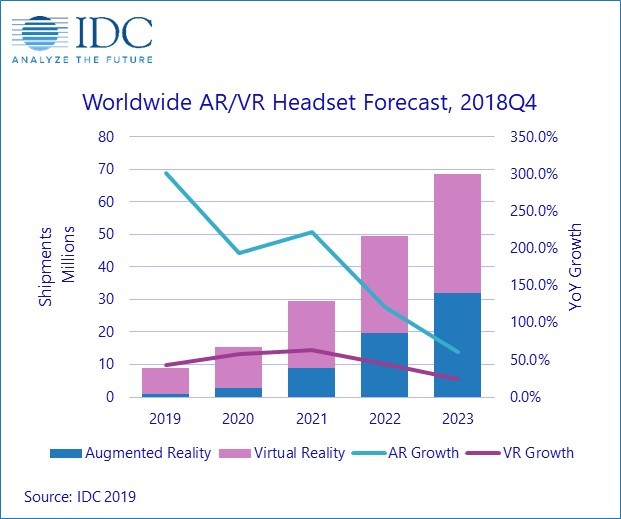

Worldwide shipments of augmented reality and virtual reality (AR/VR) headsets are forecast to reach 8.9 million units in 2019, up 54.1% from the prior year according to the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker.

Strong growth is expected to continue as global shipments climb to 68.6 million in 2023 with a compound annual growth rate (CAGR) of 66.7% over the 2019-2023 forecast period.

IDC forecasts shipments for virtual reality headsets to reach 36.7 million units in 2023 with a five-year CAGR of 46.7%. Among the various products and form factors, Standalone headsets will account for 59% of all VR headsets shipped in 2023, followed by Tethered Head-Mounted Displays (HMDs) with 37.4% share of shipments and Screenless Viewers accounting for the remainder. In the AR headset market, total shipments are expected to reach 31.9 million units in 2023 with a 140.9% CAGR. Once again, Standalone headsets will lead the market with 17.6 million units shipped and 55.3% share in 2023 followed by Tethered HMDs with 44.3% share and Screenless Viewers capturing less than 1%.

“New headsets from brands such as Oculus, HTC, Microsoft, and others will help fuel the growth in 2019 and beyond,” said Jitesh Ubraniresearch manager for IDC’s Mobile Device Trackers. “However, it’s not just new products from headset makers that will drive the AR/VR market forward. Qualcomm’s latest silicon is also expected to play a major role in enabling hardware partners and providing network connectivity for content creators.”

When it comes to the overall AR/VR headset market, roughly two-thirds of all headsets will be shipped into the commercial segment in 2023 as many AR headsets and a significant portion of VR headsets will cater to this audience. The types of industries and use cases for these deployments will vary dramatically, but key vertical use cases include everything from training and services to retail and design.

“Some of the early movers in the VR space have wisely moved to embrace commercial use cases for the technology as they wait for more consumer-centric experiences beyond gaming and video to materialize,” said Tom Mainelli, group vice president, Devices & AR/VR at IDC. “The Augmented Reality side of the headset business has been largely enterprise-focused from the start, with a few notable exceptions, and we expect that trend to continue for the foreseeable future as most consumers in the near term will experience AR through their smartphone or tablet.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.