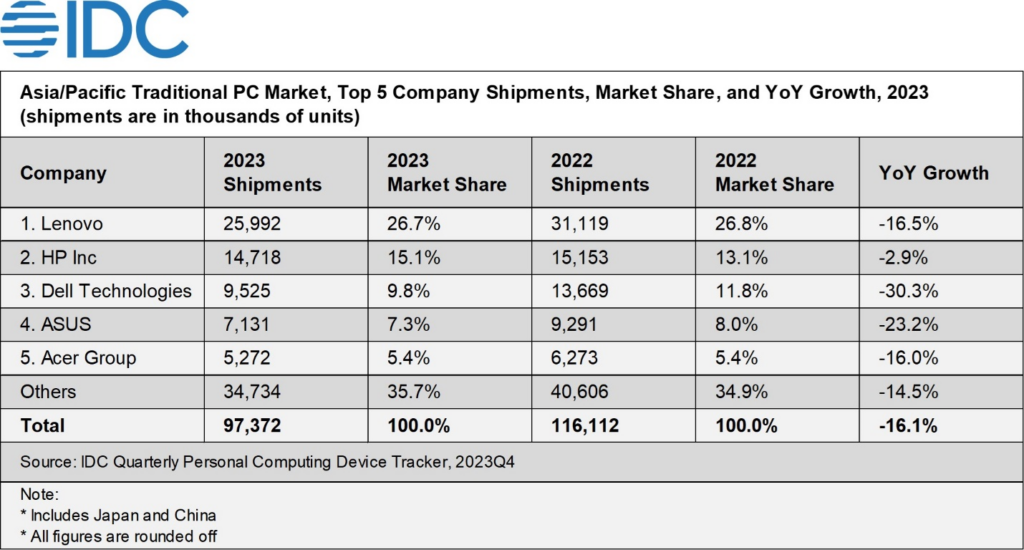

The traditional PC market in Asia/Pacific, including Japan and China, experienced a significant decline of 16.1% in 2023, with shipments totaling 97.4 million units, according to the latest data from IDC. The research firm’s Q4 2023 reporting suggests that the market is not expected to bounce back significantly in 2024 due to weak demand and a sluggish economic recovery.

IDC says that the year-on-year decrease across all quarters can be attributed to declining demand in both consumer and commercial segments. Purchases were soft given that a good portion of demand was already fulfilled during the COVID-19 pandemic, and ongoing challenging economic conditions didn’t help either. IDC notes that market players faced high inventory levels and had to limit shipments to avoid overstocking, particularly in the first half of the year.

The consumer PC market saw a 17.4% drop to 48.5 million units, with desktop shipments falling by 22.0% and consumer notebooks by 15.8% year-on-year. IDC states that inflation and rising interest rates weakened purchasing power, while a shift in consumer spending priorities further impacted demand.

Similarly, the commercial PC market decreased by 14.8% to 48.8 million units. IDC reports that private sector businesses were cautious with IT spending and reduced orders or delayed PC replacements amid unfavorable macroeconomic conditions. Public sector shipments also declined compared to recent years as pandemic-driven demand slowed down, resulting in fewer projects.

IDC forecasts a mere 0.4% growth in traditional PC shipments for the Asia/Pacific region in 2024, with volumes expected to reach 97.8 million units. The market is likely to remain weak in the first half of the year before experiencing some growth in the second half, particularly in China and Japan. IDC anticipates an economic recovery in China, spurring PC purchases, while Japan is expected to see a pickup in replacement demand for PCs purchased during the 2019 spike before the Windows 7 End of Support.

IDC says that while 2024 is expected to remain challenging for the PC industry, new technologies such as on-device Artificial Intelligence (AI), along with an anticipated rebound in consumer demand and an increase in commercial renewals, are expected to lead to 7.9% growth in 2025. However, IDC cautions that businesses and end-users are likely to replace their devices more gradually under economic uncertainty, with AI-enabled PCs slowly replacing existing machines over the next several years.

Last year, the expectations of the display industry were high for IT sales in 2024. The expected rebound in IT sales may not happen this year according to the analysis of the fourth quarter of last year and that is a growing concern for the industry.