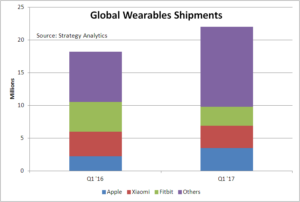

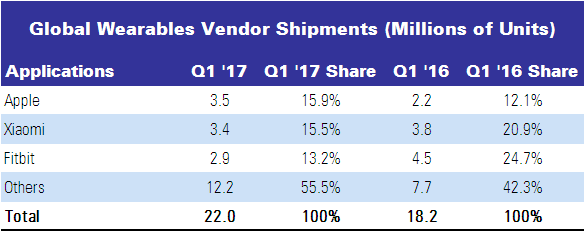

According to the latest research from Strategy Analytics, global wearables shipments reached 22 million units in the first quarter of 2017 with Apple capturing 16% of the market, overtaking Fitbit. Global wearable shipments rose 21% compared to the 2016 first quarter figure of 18.2 million. The increase was partly due to the stronger demand for new smartwatch models in North America, Western Europe and Asia.

Apple shipped 3.5 million wearables worldwide in the first quarter, rising 59% compared to the 2.2 million units shipped in the same quarter in 2016, partly due to the new Apple Watch Series 2, which is selling relatively well.

Xiaomi shipped 3.4 million wearables for a 15% percent market share in the quarter, although demand for its Mi Band fitness range was relatively flat across its core markets of Asia.

Fitbit shipped 2.9 million wearables in the quarter, falling 36% compared to the 4.5 million shipped in the first quarter of 2016. Fitbit lost its wearables leadership to Apple, due to slowing demand for its fitness bands.

Apple tops the wearables market in 2017 Q1

Apple tops the wearables market in 2017 Q1

Analyst Comment

This is good market growth, but not exactly explosive. The number of significant vendors is small and as we reported recently, Fitbit is not doing at all well in financial terms, although fitness tracking seems to be the most compelling application (Fitbit Result 05/05/2017). I have previously written about the lack of compulsion that I feel to adopt a smartwatch, although I tend to like gadgets and am usually an ‘early adopter’. (Are Smartwatches a Product of the Future…?). Thinking about the development of the smartwatch, at the moment it seems to me that the state of development is somewhat like the tablet market before the iPad. There was a market, but the form factor and functions just seemed too clunky and they were too expensive. Once Apple got everything right, the market very rapidly took off. The same seems likely to happen to smartwatches, but we’re some way from that at the moment. (BR)