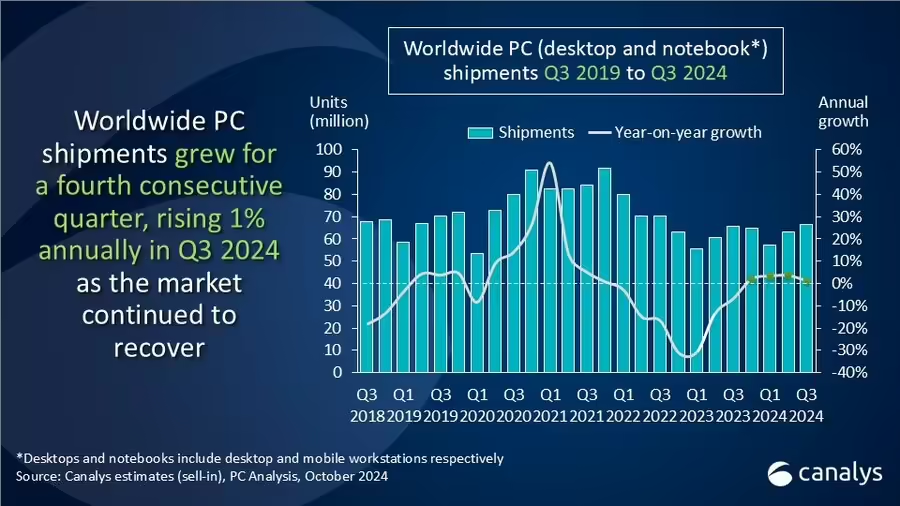

The global PC market has shown modest growth for the fourth consecutive quarter, with shipments of desktops, notebooks, and workstations rising 1.3% YoY, according to the latest Canalys data. Total shipments reached 66.4 million units in the third quarter of 2024, a steady recovery after a period of stagnation in the industry. Notebooks, which include mobile workstations, played a key role seeing a 2.8% increase to 53.5 million units, while desktop shipments, including desktop workstations, dropped by 4.6% to 12.9 million units.

This anemic recovery is being driven primarily by commercial demand, as businesses worldwide upgrade their systems to Windows 11 ahead of the Windows 10 end-of-life deadline in October 2025.

According to Ishan Dutt, Principal Analyst at Canalys, “The PC market recovery is now well underway, with several positive indicators suggesting stronger performance in the coming quarters.”

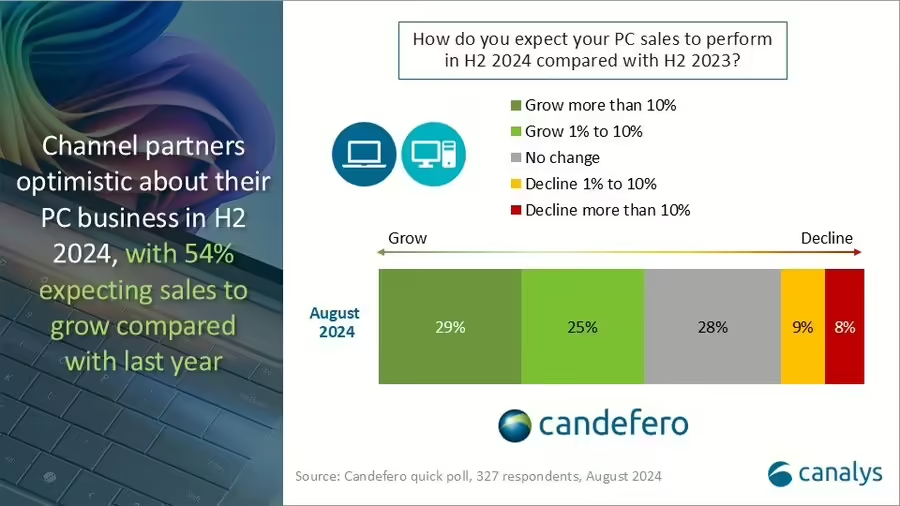

Businesses, facing extended support fees for older systems, are propelling commercial procurement, with 54% of Canalys’ surveyed channel partners expecting growth in PC sales in the second half of 2024 compared to the same period last year.

Lenovo retained its position as the top PC vendor globally, shipping 16.5 million units, marking a 3% year-on-year increase. HP followed closely behind, with 13.5 million units shipped, achieving flat growth. Dell, however, experienced a 4% decline in shipments, down to 9.8 million units.

Asus saw the highest growth among the top five vendors, with shipments rising by 16% to 5.5 million units, while Apple experienced a sharp decline of 17.5%, shipping just over 5.1 million Macs compared to 6.2 million the previous year.

| Vendor | Q3 2024 shipments | Q3 2024 market share | Q3 2023 shipments | Q3 2023 market share | Annual growth |

| Lenovo | 16,490 | 24.80% | 16,036 | 24.50% | 2.80% |

| HP | 13,572 | 20.40% | 13,513 | 20.60% | 0.40% |

| Dell | 9,847 | 14.80% | 10,255 | 15.60% | -4.00% |

| Asus | 5,513 | 8.30% | 4,762 | 7.30% | 15.80% |

| Apple | 5,114 | 7.70% | 6,197 | 9.50% | -17.50% |

| Others | 15,848 | 23.90% | 14,796 | 22.60% | 7.10% |

| Total | 66,384 | 100.00% | 65,557 | 100.00% | 1.30% |