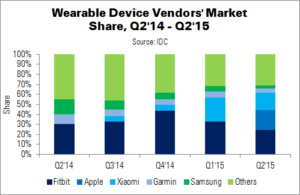

Following the launch of the Apple Watch, Apple entered the worldwide wearable market in second place in Q2’15 – just 4.4% behind market leader Fitbit. IDC says that 3.6 million Apple Watches were shipped in Q2, just 800,000 behind Fitbit’s 4.4 million units. In total, 18.1 million wearables were shipped in the quarter, up 223.2% YoY (from 5.6 million in Q2’14).

“Anytime Apple enters a new market, not only does it draw attention to itself, but to the market as a whole”, Said IDC’s Ramon Llamas. “Its participation benefits multiple players and platforms within the wearables ecosystem, and ultimately drives total volumes higher. Apple also forces other vendors – especially those that have been part of this market for multiple quarters – to re-evaluate their products and experiences. Fairly or not, Apple will become the stick against which other wearables are measured, and competing vendors need to stay current or ahead of Apple. Now that Apple is officially a part of the wearables market, everyone will be watching to see what other wearable devices it decides to launch, such as smart glasses or hearables”.

Apple’s arrival had the greatest impact on smart wearables, where it took around a 65% market share. Overall wearable market leader Fitbit only ships ‘basic’ wearables – a category expected to decline in the coming years. Price and functionality are the main differentiator between these categories.

| Top Five Wearable Vendors’ Shipments, Market Share and Growth, Q2’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share | YoY Change |

| Fitbit | 4.4 | 1.7 | 24.3% | 30.4% | 158.8% |

| Apple | 3.6 | 0.0 | 19.9% | 0.0% | N/A |

| Xiaomi | 3.1 | 0.0 | 17.1% | 0.0% | N/A |

| Garmin | 0.7 | 0.5 | 3.9% | 8.9% | 40.0% |

| Samsung | 0.6 | 0.8 | 3.3% | 14.3% | -25.0% |

| Others | 5.7 | 2.6 | 31.5% | 46.4% | 119.2% |

| Total | 18.1 | 5.6 | 100.0% | 100.0% | 223.2% |

| Source: IDC | |||||

In vendor terms, Fitbit performed well: triple-digit volume growth, double-digit revenue and profit growth; and new partnerships. The company has remained true to its value proposition of tracking fitness to encourage healthier lifestyles, rather than aiming for multi-purpose functionality like smartwatches do.

Apple is within reach of Fitbit’s market leadership, and is ‘just getting started’ with its Watch. IDC views the development of the WatchOS platform as important; the next version will support native apps.

Xiaomi entered the wearables market last year, with the Mi Band. Since then its growth has been strong in China, as the vendor sells its products at very low prices. The company recently expanded to markets outside of China, although growth has been limited by its few distribution channels.

Garmin, like Fitbit, has been successful because of its focus on a single category: in this case, fitness devices for ‘citizen athletes’ (runners, cyclists and swimmers). However, increasing competition from companies such as Fitbit and Xiaomi has cut into its share. Garmin’s new ConnectIQ platform may help, as it attempts to offer access to third-party applications, watch faces, widgets and data fields for customisation.

Samsung narrowly made it into the top five, just beating Huawei and Jawbone. Its Gear S and Gear Fit continued to be successful, and a redesigned Gear S2 is expected to be announced at IFA. However, the company has historically only made its wearables compatible with its own high-end smartphones, limiting its potential reach.