Wearables – Wearables are the highlight of the consumer electronics industry this year, with many believing that the release of the Apple Watch will further the consumer’s interest in these products. The next step is to figure out what these devices will be used for.

One of the key uses that Apple is proposing is Apple Pay (even though this also works with the iPhone without the Apple Watch). Some analysts, including me, see Apple Pay as a major shift by Apple towards more service-oriented revenue.

Now, some retailers have decided to stop the use of Apple Pay in their stores. These companies are CVS and Rite Aid, two US-based pharmacies that have a countrywide reach. Both companies are members of the Merchant Customer Exchange (MCX) that is developing a new payment system called CurrentC, that is based on using QCR codes and a smartphone and forgoes the use of NFC. There is a heavy debate waging about which system is more secure, NFC based payments or CurrentC. Surely the CurrentC system is more of a hassle for the consumer than the sleeker Apple Pay system? However, there are quite a few members of MCX that have not moved to disable NFC payments just yet.

It seems that some retailers want to stop NFC-based payments before they cover a larger part of the payment ecosystem. The 2013 Federal Payment Study of the USA has shown that in 2012, there were 26.2 billion transactions worth almost $2.5 trillion. The total number of non-cash payments reached 122.8 billion transactions, representing a considerable total value of $79 trillion.

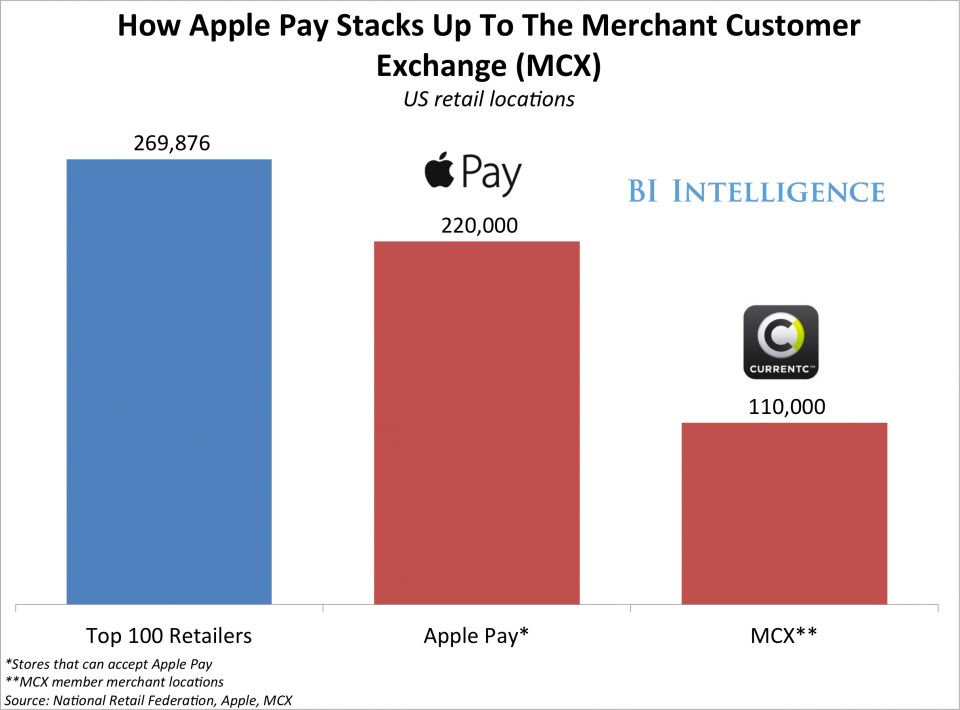

When we look at Apple Pay now, we can see a strong relation to credit card companies like Visa. While many say that Apple Pay is more secure than actual credit card payments, the actual money transfer still uses the credit card payment system. We have to assume that this also means that merchants have to pay the credit card fee of 2% to 3% of the purchase price. I would also guess that Apple is taking a small part of that payment, if the payment is made via Apple Pay. This is why I think Apple Pay will be big business for Apple in the future. In the very short time frame that Apple Pay has been on the market, it has accomplished a much higher acceptance than MCX, which started in August 2012.

When we take just the US numbers from the above mentioned study, we see that in 2012, credit card payments accounted for a total of over $60 billion in credit card fees. Based on data from the US Census Bureau, Economagic shows the following chart of total US retail sales development over the last few years.

This shows that we are on track to reach $5 trillion in retail sales this year, but only a small portion of this is actually based on credit card transactions. If wearable devices and Apple Pay were to shift only a very small percentage of this sales volume to credit card transactions, we could be seeing a sizable effect on the retailers’ bottom lines.

There is also the aspect of fraud. Card-based unauthorized transactions including all types of cards reached 31.1 million transactions with a value of $6.1 billion. This burden does not go back to the consumer but is shared between the banks and the merchants.

Display Central Comment

In my opinion, these numbers explain two aspects of the NFC payment development. First, it explains why credit card companies are so willing to work with Apple on the Apple Pay system (more sales and lower risk of fraud). Secondly, it explains why merchants are no big fans of credit card-based payment systems like Apple Pay (more credit card related fees lowers their profitability). Interesting times. – Norbert Hildebrand