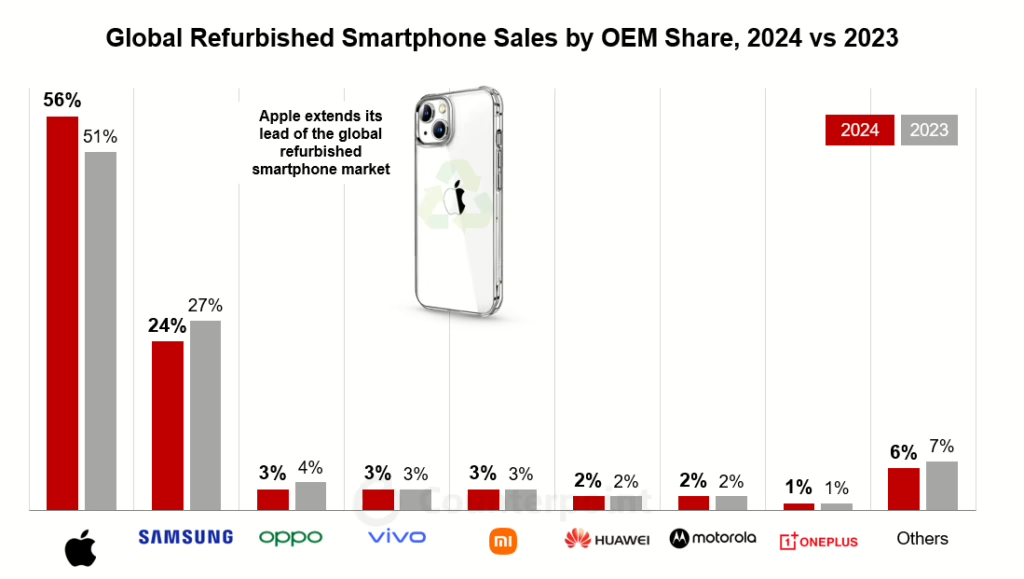

In a market showing signs of maturation, Apple has significantly strengthened its grip on the global refurbished smartphone sector, according to the latest data from Counterpoint.

The refurbished smartphone market grew by 5% YoY in 2024, maintaining similar growth rates seen since 2022. This modest but steady expansion outpaced the new smartphone market, which grew by 3% after a challenging 2023.

Apple has emerged as the primary driver of growth in the secondary market, increasing its market share from 51% in 2023 to a commanding 56% in 2024. This growth occurred despite significant supply constraints, particularly for newer iPhone models.

“Apple’s growth this time was mostly made up of older models like the iPhone 11 and 12 series,” explained Glen Cardoza, Senior Research Analyst at Counterpoint Research. “Even with the iPhone 13 and 14 series being in the market for some time, many consumers held on to these devices for longer, creating a supply crunch.”

The limited availability of newer iPhone models contributed to an 11% decline in the global average selling price (ASP) of refurbished smartphones, which fell to $394 in 2024 from $445 in 2023.

Sales of ‘as is’ smartphones – those that are simply cleaned and repackaged with no technical work carried out – grew 13% YoY. “More durable devices have resulted in better-quality trade-ins, reducing the need for refurbishment. Also, rising costs of spare parts, labor and equipment mean many players are simply selling used smartphones ‘as is’ to maintain margins,” Cardoza noted.

Meanwhile, 5G smartphones witnessed a significant surge across brands, accounting for 42% of the global refurbished smartphone market in 2024, up from 28% in 2023.

“2024 saw flatlining of growth in the refurbished market due to supply constraints. But we expect a recovery in 2025 due to more consumers upgrading their devices considering the post-Covid purchasing spike between 2020 and 2022,” said Jan Stryjak, Associate Director at Counterpoint Research. “The focus will be on strategic inventory management across secondary businesses, which in turn may lead to increased trade with emerging markets.”