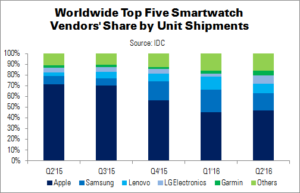

Q2’16 was the first time that the global smartwatch market contracted YoY, with shipments falling 32%, says IDC. Shipments reached 3.5 million units: significantly down from the 5.1 million shipped in Q2’15. Apple, shipping 1.6 million units, maintained the top rank, but was the only top-five vendor to experience an annual decline. IDC does note, however, that Q2’15 was the launch quarter for the Apple Watch, providing a poor annual comparison.

Consumers have been delaying smartwatch shipments since early 2016, in anticipation of a hardware refresh, said IDC’s Jitesh Ubrani. WatchOS improvements are not expected until later this year. These two factors have effectively stalled Apple Watch sales. Apple still leads the market by a long way, however, and a decline at Apple turns into a decline for the entire segment. Ubrani added that “though we expect improvements next year, growth in the remainder of 2016 will likely be muted.”

Traditional watchmakers are still largely absent from the smartwatch markets. This is changing slowly as companies such as Fossil and Casio enter. Ramon Llamas of IDC said that “participation from traditional watchmaker brands is imperative to deliver some of the most important qualities of a smartwatch sought after by end-users, namely design, fit, and functionality.” These factors, combined with brand recognition and existing distribution channels, make it reasonable to assume that the smartwatch market will grow in the future.

IDC expects to see continued platform development; cellular connectivity; and an increasing number of apps in the smartwatch market, which will return to growth in 2017.

| Top Five Smartwatch Vendors’ Shipments, Share and Growth, Q2’16 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY volume Change |

| Apple | 1.6 | 3.6 | 47% | 72% | -55% |

| Samsung | 0.6 | 0.4 | 16% | 7% | 51% |

| Lenovo | 0.3 | 0.2 | 9% | 3% | 75% |

| LG Electronics | 0.3 | 0.2 | 8% | 4% | 26% |

| Garmin | 0.1 | 0.1 | 4% | 2% | 25% |

| Others | 0.6 | 0.6 | 16% | 11% | -1% |

| Total | 3.5 | 5.1 | 100% | 100% | -32% |

| Source: IDC | |||||

As mentioned above, Apple led the market – although its share was down significantly from Q2’15’s 72%, to 47%. It faces the same challenges as other vendors, but enjoys high levels of exposure of both its watch and brand, giving it an advantage.

Next up is Samsung, which has secured distribution deals with telcos in the USA. Its Gear S2 lineup enjoyed a strong launch, as Samsung has successfully unlinked the smartwatch from the smartphone. A focus on telcos is likely to remain Samsung’s key strategy going forward.

Lenovo is still enjoying its ‘first-mover’ advantage, as its sub-brand Motorola was one of the first to produce an Android Wear smartwatch with a circular display. Attempts to branch out into the fitness market with the Moto 360 Sport have met with mixed results.

Like Samsung, LG also has a presence in the US telco channel, which has proven beneficial. The company recently released a new model of its G Watch Urbane, supporting 4G connectivity – the first Android Wear model to do so. However, it has been limited by a lack of complete support from Google.

The top five list was rounded out by Garmin, which has almost doubled its share since Q2’15 thanks to the introduction of new models. However, Garmin is still catering to a niche audience – athletes – limiting its reach.