As active-matrix organic light-emitting diode (AMOLED) displays quickly displace liquid crystal displays (LCDs) in smartphones, panel makers are rapidly adding new production capacity, accelerating the demand for the fine metal mask (FMM), a critical production component used to manufacture red-green-blue (RGB) AMOLEDs.

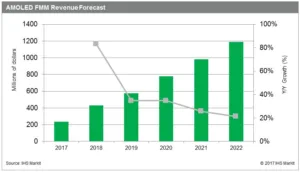

The FMM market is forecast to grow at a compound annual growth rate (CAGR) of 38 percent from $234 million in 2017 to $1.2 billion in 2022, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

In the AMOLED manufacturing process, FMM is a production component used to pattern individual red, green and blue subpixels. A heating source evaporates organic light-emitting materials, but vapor deposition can only be controlled precisely with the use of a physical mask. FMM — a metal sheet, only tens of microns thick, with millions of very small holes per panel — is the only production-proven method of accurately depositing RGB color components in high-resolution displays.

“FMM has become a bottleneck in the supply of AMOLED panels due to the manufacturing technology challenges posed by increasing resolutions and a limited supply base. As pixels per inch (PPI) increase, thinner FMMs with finer dimensions are required, which reduce mask production yield and useable lifetime,” said Jerry Kang, senior principal analyst of display research at IHS Markit.

Dai Nippon Printing (DNP) is the dominant FMM supplier, owing to its proprietary etching technology for very thin metal foils and mass production experience. Currently, DNP’s FMMs are used to fabricate the vast majority of AMOLED smartphone panels, and exclusively for high-end quad high definition (QHD) resolutions. “Most panel makers are now trying to procure DNP’s FMM in hopes of being able to quickly ramp new fabs to high yields,” Kang said.

The critical nature of FMM and rapid demand growth are encouraging a number of companies to develop alternative FMM technologies and enter the market. Panel makers are also encouraging new players as a second source to mitigate supply chain risk and create price competition. As the supply of FMM is a determinant factor in the AMOLED display market to meet its projected growth rates, and with the FMM market forecast to grow five times its current size by 2022, FMM is garnering intense interest from both set and panel makers alike and creating new opportunities for suppliers.

The AMOLED Shadow Mask Technology & Market – 2017 report from IHS Markit provides a comprehensive analysis of the latest technology and market trends for FMMs and open masks, as well as mask and panel supplier status updates, including forecasts of revenues, units, area and prices from 2014 to 2022.

In the AMOLED manufacturing process, FMM is a production component used to pattern individual red, green and blue subpixels. A heating source evaporates organic light-emitting materials, but vapor deposition can only be controlled precisely with the use of a physical mask. FMM — a metal sheet, only tens of microns thick, with millions of very small holes per panel — is the only production-proven method of accurately depositing RGB color components in high-resolution displays. “FMM has become a bottleneck in the supply of AMOLED panels due to the manufacturing technology challenges posed by increasing resolutions and a limited supply base. As pixels per inch (PPI) increase, thinner FMMs with finer dimensions are required, which reduce mask production yield and useable lifetime,” said Jerry Kang, senior principal analyst of display research at IHS Markit. Dai Nippon Printing (DNP) is the dominant FMM supplier, owing to its proprietary etching technology for very thin metal foils and mass production experience. Currently, DNP’s FMMs are used to fabricate the vast majority of AMOLED smartphone panels, and exclusively for high-end quad high definition (QHD) resolutions. “Most panel makers are now trying to procure DNP’s FMM in hopes of being able to quickly ramp new fabs to high yields,” Kang said. The critical nature of FMM and rapid demand growth are encouraging a number of companies to develop alternative FMM technologies and enter the market. Panel makers are also encouraging new players as a second source to mitigate supply chain risk and create price competition. As the supply of FMM is a determinant factor in the AMOLED display market to meet its projected growth rates, and with the FMM market forecast to grow five times its current size by 2022, FMM is garnering intense interest from both set and panel makers alike and creating new opportunities for suppliers. The AMOLED Shadow Mask Technology & Market – 2017 report from IHS Markit provides a comprehensive analysis of the latest technology and market trends for FMMs and open masks, as well as mask and panel supplier status updates, including forecasts of revenues, units, area and prices from 2014 to 2022.